Although many experts believe a Solana exchange-traded fund (ETF) is unlikely in the near future, one VanEck executive suggests that a fraud case from 2018 might provide insights on how to change this outlook.

Matthew Sigel, VanEck’s Head of Digital Assets Research, recently shared on X that his firm still considers Solana (SOL) a commodity, similar to Bitcoin (BTC) and Ether (ETH). This classification is crucial for Solana to secure its own crypto ETF in the U.S. “This view is supported by evolving legal perspectives, where courts and regulators are starting to recognize that some crypto assets may act as securities in primary markets but function as commodities in secondary markets,” he explained on August 20.

Sigel highlighted a six-year-old, now-closed case against My Big Coin, a fraudulent crypto payments company, as a relevant precedent. In 2018, the Commodity Futures Trading Commission (CFTC) charged My Big Coin’s founders with fraud for misrepresenting the token’s value and use, violating the Commodities Exchange Act. The defendants argued that My Big Coin (MBC) wasn’t a commodity because there were no futures contracts referencing it. However, the judge ruled that MBC is a “virtual currency” akin to Bitcoin, which led to the CFTC’s classification of MBC as a commodity and allowed the case to proceed.

The founder was later convicted in 2022, receiving a 100-month prison sentence and ordered to pay $7.6 million in restitution. Sigel suggested that this reasoning could influence how digital assets like Solana are treated and potentially affect ETF regulation.

Read more: Solana Memecoin Protocol Announces Upcoming ‘Short Squeeze’ Platform

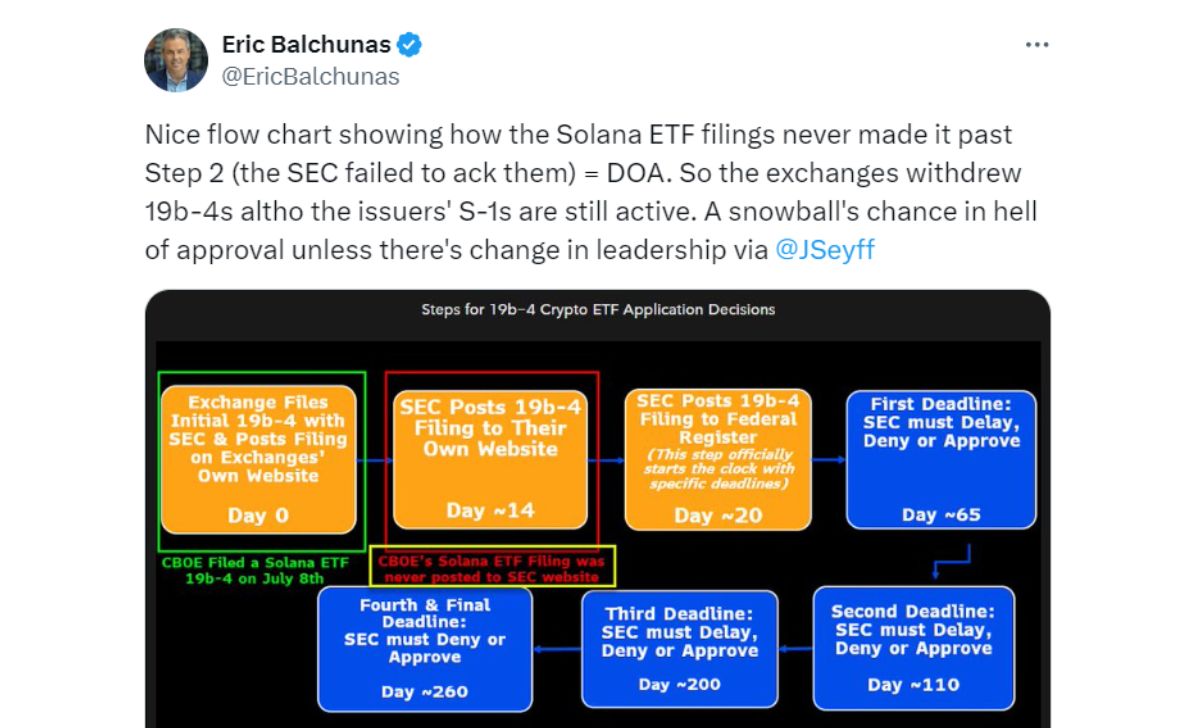

In contrast, other ETF experts are less hopeful. Bloomberg ETF analyst Eric Balchunas noted that after Cboe removed its filings for Solana ETFs, the likelihood of approval is extremely low. On August 16, it was reported that Cboe had taken down the 19b-4 filings for two potential Solana ETFs from its website.

Some speculate that the U.S. Securities and Exchange Commission (SEC) may have rejected the filings due to concerns about Solana’s classification as a security. “There’s virtually no chance in 2024, and if Harris wins, it’s likely the same for 2025. The only hope is if Trump wins,” Balchunas commented on his original post. Nate Geraci, president of ETF Store, also stated that under the current administration, a Solana ETF is unlikely.

Despite Cboe’s actions, Sigel mentioned that VanEck’s S-1 filing is still active. “Exchanges like Nasdaq and Cboe file rule changes (19b-4) to list new ETFs, but issuers like VanEck handle the prospectus (S-1). Ours remains in play.”

Cointelegraph has reached out to Cboe Global Markets for further comment.

Cre: cointelegraph.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]