Approximately 75% of all circulating Bitcoin has remained unmoved for the past six months or more, according to on-chain data.

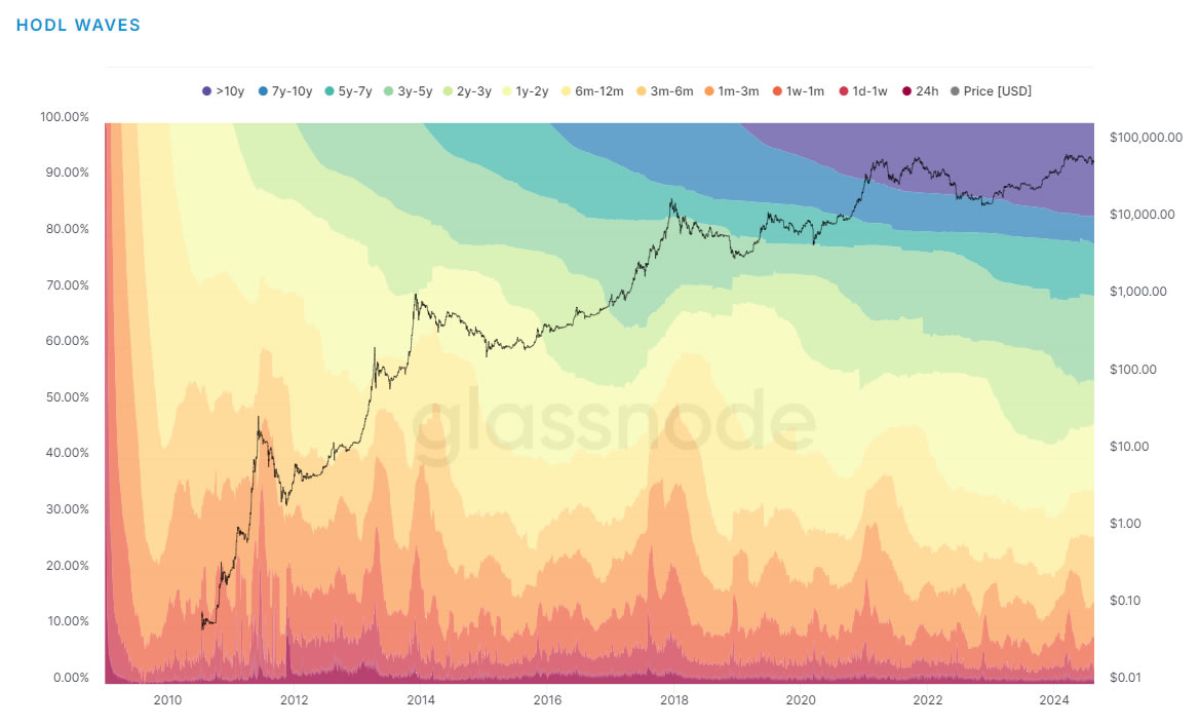

This insight comes from Glassnode’s hodl wave chart, which analyzes blockchain data to provide a macro perspective on Bitcoin held in wallets based on the last time they were moved.

The data indicates that about 74% of Bitcoin has been stationary throughout most of 2024, despite the cryptocurrency experiencing a 21% drop from its all-time high. This trend suggests that long-term investors are increasingly viewing Bitcoin as a store of value, possibly in anticipation of future price increases.

BTC hodl waves

The tendency to hold Bitcoin for extended periods also reduces the available supply for trading, which could lead to price appreciation as demand increases and supply diminishes.

Meanwhile, in an Aug. 19 post on X (formerly Twitter), on-chain analyst James Check noted that over 80% of short-term Bitcoin holders are currently underwater, having purchased their holdings at prices higher than the current spot price.

He warned that this could lead to further declines if these investors panic sell, as seen in previous years. Short-term holders are defined as those who have held Bitcoin for fewer than 155 days.

Read more: Australia Shuts Down 600 Crypto Scams, Warns AI Could Escalate Threat

“This is similar to 2018, 2019 and mid-2021, when many investors were at risk of panicking, potentially triggering a bearish trend”, Check commented.

The broader market sentiment remains bearish, with the Crypto Fear & Greed Index showing a score of 28, placing it deep in fear territory. In recent weeks, the index has returned to fear levels not seen since December 2022.

Bitcoin prices briefly exceeded $60,000 over the weekend but have since declined sharply, falling to $58,619 at the time of writing.

Cre: cointelegraph.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]