Bitcoin remains stable at press time but faces significant selling pressure following the liquidation on August 27. Technically, there are signs of weakness. However, this outlook could change if BTC bulls manage to push prices above the immediate resistance at $66,000, which coincides with the highs from August 23. A breakout above this level would confirm the upward trend that began on August 8.

Binance Traders Lean Bearish

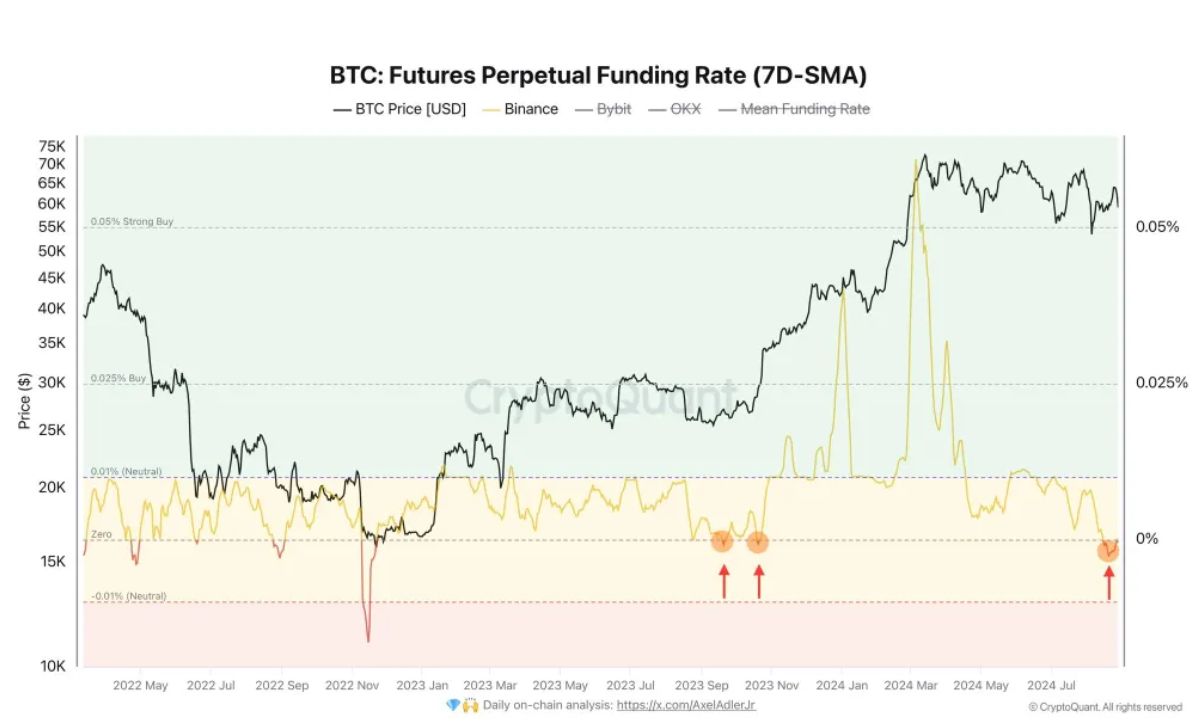

Previously, traders were cautiously optimistic, aware of Bitcoin inherent volatility and fragility. Despite prices stabilizing at current levels, an analyst on X pointed out that traders on Binance, the largest exchange by user count, are predominantly bearish. According to the analyst, more traders are opening short positions, a bearish sign for Bitcoin. If this trend continues, the coin may decline further, confirming the losses from August 24.

This shift towards a bearish sentiment is occurring even as most traders remain neutral on Bitcoin. According to the CMC Crypto Fear and Greed Index, traders adopted a wait-and-see approach as of August 28. This neutral sentiment has persisted since early August when a market downturn led to a spike in fear, the highest since early September 2023. The only time traders were extremely bullish over the past year was when Bitcoin surged to it’s all-time high of $73,800.

If prices remain weak while sentiment stays neutral, it could provide an opportunity for bullish traders in the short term. A recovery above $63,000, which would reverse the losses from August 27, might spark renewed demand and potentially lead to further gains above the August 2024 highs.

Read more: Web3 CEO Discusses Bitcoin’s Role in AI Data Provenance

Why Is the Funding Rate Positive Despite Falling BTC Prices?

Despite the cautious optimism, the average funding rate across major exchanges like Binance, Bybit and OKX is positive at 0.002%. This means that traders holding short positions are being paid to maintain them. Typically, a positive funding rate indicates that perpetual contracts are trading at a premium over the spot price, a situation that could encourage more selling and exacerbate the downtrend.

Usually, funding rates are positive when prices are rising, reflecting bullish sentiment. Conversely, they turn negative during price declines, forcing leveraged short sellers to pay those betting on price increases.

Cre: bitcoinist.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]