Bitcoin is showing strong momentum, potentially breaching $60,000. However, technical analysis indicates that more effort is needed for a sustained bullish trend. Breaking through the local resistance at around $63,000 is crucial. A decisive close above this level, accompanied by high volume, would confirm the bullish sentiment from August 8 and suggest a possible continuation into Q1 2024.

Bitcoin’s Potential to Reach $500,000 by 2029

A sustained rise beyond $66,000, $72,000, and even previous all-time highs could drive demand and push prices to new peaks by year-end. With the Federal Reserve planning to cut interest rates, which will likely support an accommodative monetary policy, Bitcoin is expected to gain further traction as an inflation hedge.

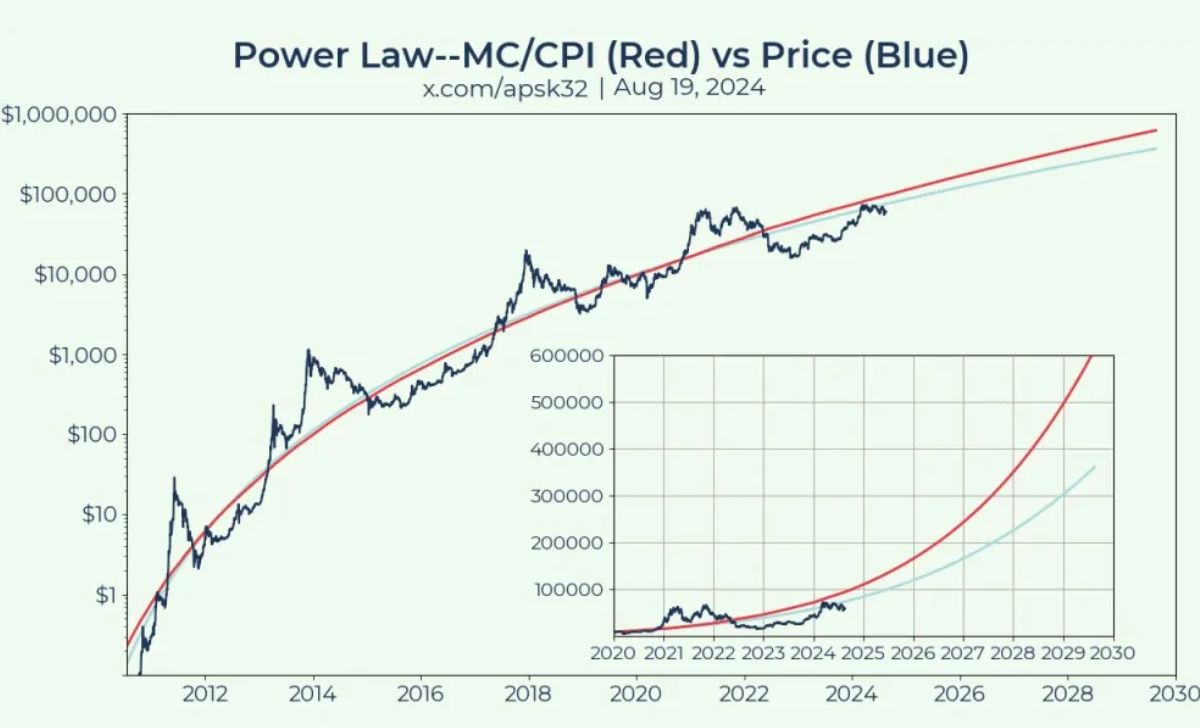

An analyst on X suggests that Bitcoin’s value could significantly exceed current expectations when accounting for inflation and the dynamic supply of Bitcoin. The analyst highlights that traditional power law models, commonly used to predict Bitcoin’s price, often ignore inflation and the increasing supply of BTC. Adjusting these models to incorporate these factors could see Bitcoin reaching $500,000 by 2029, a 66% increase over previous estimates. The market cap of Bitcoin is crucial in this refined model.

Metcalfe’s Law and Institutional Demand

This perspective aligns with Metcalfe’s Law, which states that the value of a network, such as Bitcoin, is proportional to the square of the number of users. Although market cap is not a perfect measure, it provides a more accurate estimate of Bitcoin’s intrinsic value than the spot price alone.

Read more: Crypto Law Firm Fails to Force SEC Decision on Ether Classification

Traders are also anticipating that inflows from spot ETFs will further boost Bitcoin’s valuation, similar to the effects observed in Q1 2024. Currently, spot Bitcoin ETFs hold over $55.96 billion in BTC, with BlackRock’s IBIT alone attracting $21.5 billion since its launch in January 2024.

Cre: bitcoinist.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]