On-chain data reveals a recent rebound in Bitcoin mining hashrate, indicating that miners are expanding their operations.

Bitcoin Mining Hashrate Recovers from Recent Lows

The “Mining Hashrate” measures the total computing power connected to the Bitcoin network, expressed in terahashes per second (TH/s). An increase in this metric suggests that existing miners are upgrading their facilities and new miners are joining, reflecting a positive outlook on mining.

Conversely, a decrease in hashrate implies that some miners are disconnecting, possibly due to reduced profitability.

Recent Trends

The 7-day moving average (MA) of Bitcoin’s mining hashrate dropped to about 610 million TH/s earlier this month from a peak of 667 million TH/s in late July. This decline was likely influenced by Bitcoin’s bearish trend during that period.

Miners primarily earn from block subsidies, which are fixed in BTC but vary with the cryptocurrency’s USD price. Bitcoin’s recent price drop below $50,000 severely impacted miner earnings. Despite this, Bitcoin has shown signs of recovery, though it’s still below the $70,000 mark it reached last month.

Read more: 2018 Fraud Case May Influence Solana ETF Approval, Says VanEck Executive

Recent Rebound

Interestingly, the 7-day MA has recently rebounded sharply, reaching 650 TH/s two days ago. This suggests that some miners may be anticipating better outcomes for Bitcoin in the near future.

Hash Ribbons Indicator

The data for the Hash Ribbons over the last few years

The “Hash Ribbons” indicator, which tracks the 30-day and 60-day MAs of the hashrate, is used to assess miner sentiment. When the 30-day MA crosses below the 60-day MA, it signals miner capitulation, a sign that miners are rapidly shutting down operations. Historically, Bitcoin has often seen price bottoms during such distress among miners.

CryptoQuant recently noted that the 30-day MA has now crossed back above the 60-day MA, which often precedes a reduction in selling pressure and potential price increases.

Current Bitcoin Price

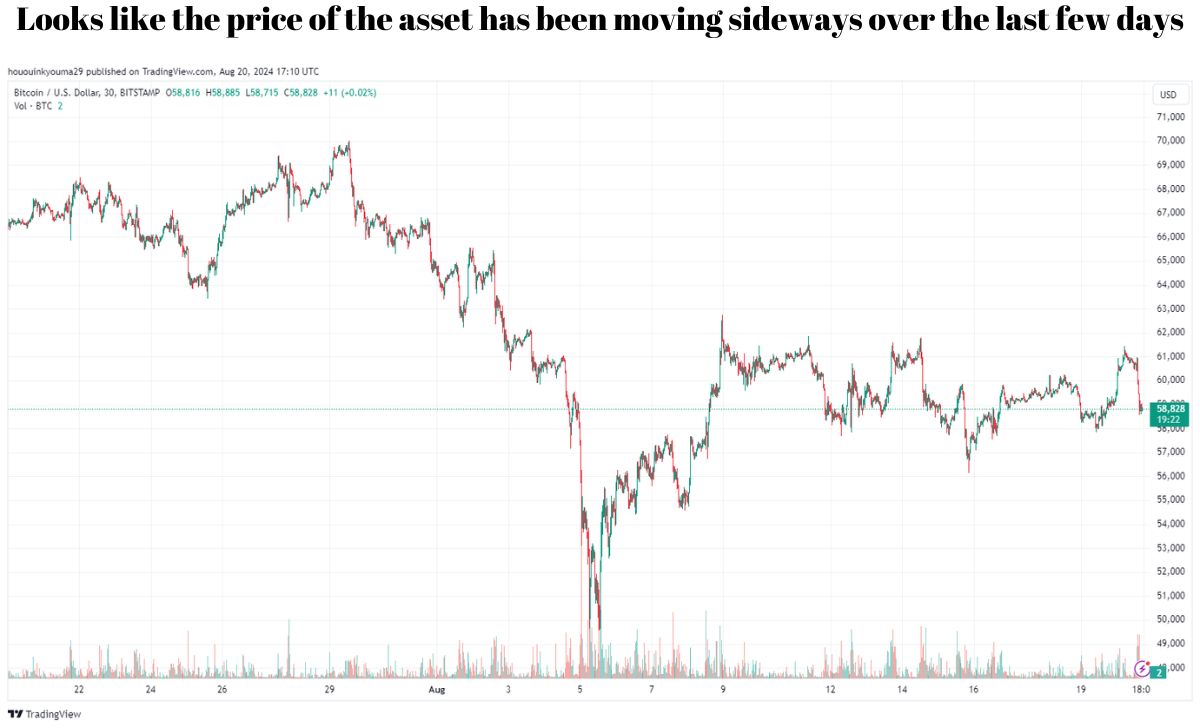

As of now, Bitcoin is trading at approximately $58,800, down 4% over the past week.

Looks like the price of the asset has been moving sideways over the last few days.

Cre: bitcoinist.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]