Centrifuge is one of the prominent projects in the DeFi space, with the mission of bringing Real World Assets (RWA) to blockchain, opening a new era for decentralized finance. But is Centrifuge really a potential solution for connecting traditional finance with the DeFi world?

In this article, AZCoin will analyze in detail the Centrifuge project and CFG token, helping you better understand the operating mechanism, highlights and investment potential in Centrifuge.

What is Centrifuge?

Centrifuge is a pioneering decentralized finance (DeFi) protocol that enables the tokenization of real-world assets into digital assets. The project connects traditional assets with DeFi, allowing businesses to access liquidity quickly and efficiently. Instead of relying on traditional lending methods, businesses can use Centrifuge to tokenize invoices, real estate, royalties and other assets, put them on the blockchain and use them as collateral for loans on the DeFi platform.

Centrifuge helps optimize the flow of finance for businesses, especially small and medium enterprises (SMEs), where access to quick financing is often difficult.

How Centrifuge works

Centrifuge operates on two main components: Centrifuge Chain and Tinlake.

Centrifuge Chain

A blockchain built on the Polkadot Substrate platform, allowing integration with the DeFi ecosystem and other blockchains such as Ethereum. Centrifuge Chain ensures security, scalability and low transaction fees, making it easy to tokenize and trade real-world assets.

Centrifuge Chain notable feature is its bridge between it and Ethereum, allowing crypto assets on Centrifuge to be used in DeFi protocols such as MakerDAO and Aave. This allows businesses to tokenize unpaid invoices or other collateral into NFTs, using them to access financing on Ethereum or other blockchains.

Tinlake

This is a Dapp built on Ethereum, allowing businesses to use crypto assets from Centrifuge to borrow capital. Tinlake helps create liquidity pools for borrowers and investors, providing a transparent and secure platform for accessing capital. Tinlake allows investors to access real-world assets with attractive returns, while borrowers can leverage liquidity from the DeFi ecosystem.

Centrifuge highlights

Centrifuge has several key features that make it a promising project in the DeFi space:

- Strong TVL growth: Centrifuge is standing out in the DeFi ecosystem with impressive growth in Total Value Locked (TVL) in asset pools. Real-world assets such as real estate, invoices and royalties can all be tokenized and contribute to the project’s TVL value.

- Integration with thePolkadot ecosystem: Centrifuge is one of the first projects to deploy on Polkadot, a blockchain known for its speed and low transaction fees. This integration not only helps Centrifuge expand its reach but also creates security and efficiency advantages.

- Collaboration with major DeFi protocols: Centrifuge has integrated with leading protocols in the DeFi space such as MakerDAO and Aave. This partnership increases liquidity for real-world assets while ensuring that DeFi protocols have more stable and less volatile collateral.

Project team, investors and partners of Centrifuge

Project team

Centrifuge was founded by individuals with extensive experience in the technology and finance fields:

- Lucas Vogelsang (Co-Founder): One of the co-founders of Centrifuge, with an extensive background in technology and finance. Prior to founding Centrifuge, Lucas worked at large technology companies and has many years of product development experience.

- Martin Quensel (Co-Founder): The second co-founder of Centrifuge and has extensive experience building large financial and technology systems. He has made significant contributions to the development of decentralized finance solutions.

Investors

The project has attracted the attention of many large investment funds such as:

- Atlantic Labs

- Blue Yard

- Crane

- Fintech Collective

The participation of these large investors not only provides strong financial resources but also ensures the long-term development of the project.

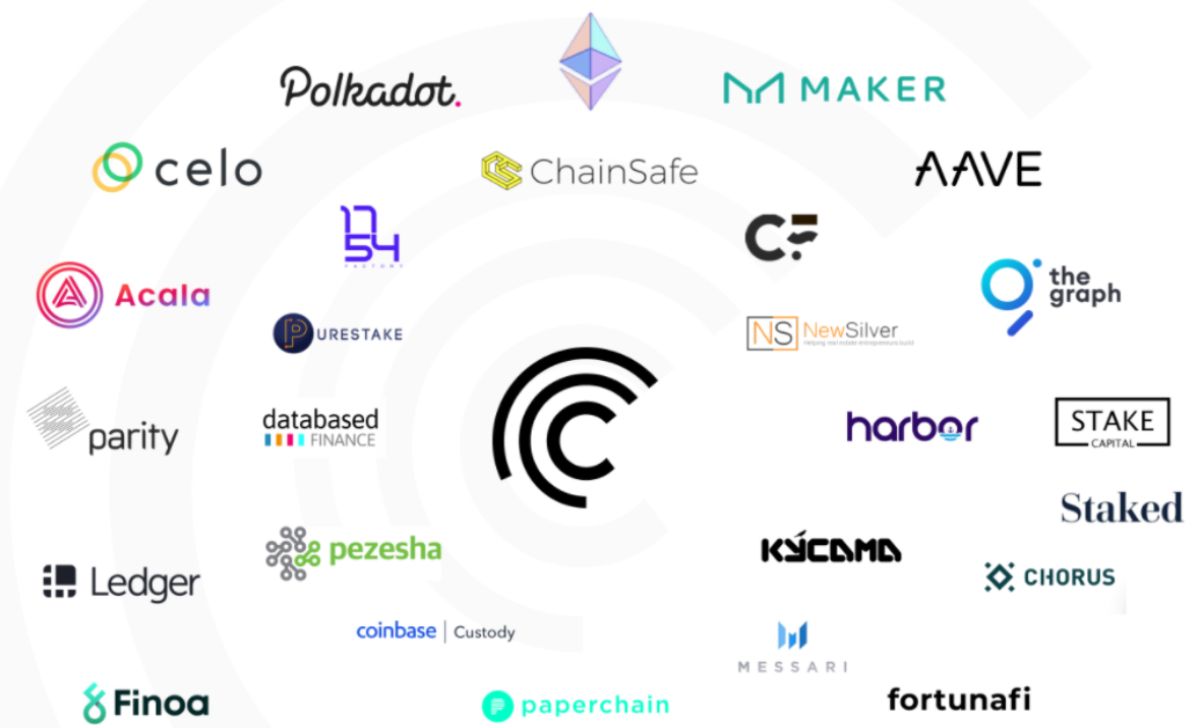

Partners

Centrifuge has also built a strong partnership network, including big names in the blockchain and DeFi industry:

- Celo

- Polkadot

- MakerDAO

- Aave

- Acala,…

These partners help Centrifuge expand its reach and provide more liquidity for crypto assets.

Overview CFG token

What is CFG Token?

CFG Token is the native token of Centrifuge, used in various cases within the project ecosystem. CFG acts as a governance token, giving users voting rights in important network decisions. In addition, CFG is also used to pay transaction fees and secure the network.

Key metrics CFG Token

- Token name: Centrifuge

- Ticker: CFG

- Blockchain: Centrifuge Chain

- Token Type: Utility and Governance

- Market cap: $175,042,042

- Circulating supply: 500,678,688 CFG

- Fully diluted market cap: $193,559,062

- Total supply: 425,000,000 CFG

- Volume 24h (14/09/2024): $987,653

CFG Token allocation

CFG Tokens are distributed to various entities within the Centrifuge ecosystem:

- Initial ecosystem: 8.3%

- Development funding: 11.8%

- Community: 7.1%

- Project foundation fund: 11.8%

- Main contributors: 27%

- Investment funds: 17.1%

- Rewards and grants: 7.3%

Where is CFG Token traded?

CFG Token is currently listed on many best crypto exchanges reputable, including:

- Coinbase

- Binance

- OKX

- Kraken,..

Secure CFG Token storage wallet

To store CFG Token, you can use the following secure wallets:

- Ledger Nano S/X

- Trezor

- Trust Wallet,…

CFG Token development roadmap

Centrifuge has been developing on a clear roadmap, with key development phases including:

- Phase 1 (2021): Launch of Centrifuge Chain and Tinlake, integration with MakerDAO and Polkadot.

- Phase 2 (2022): Expand the ecosystem, increase integration with other DeFi protocols.

- Phase 3 (2023): TVL growth and develop new applications for real assets.

Should I invest in the CFG Token project?

Centrifuge is one of the pioneering projects in tokenizing real-world assets and bringing them into the DeFi ecosystem. With the strong development of DeFi and integration with major protocols such as MakerDAO and Aave, Centrifuge promises to continue to attract many investors. CFG token has strong growth potential, especially as more and more businesses turn to Centrifuge to take advantage of liquidity from DeFi.

It is predicted that in the future, the price of CFG may increase many times as DeFi continues to expand and the real-world asset market is further exploited.

Sunmmary

Hopefully this article from AZCoin has helped you better understand Centrifuge and the potential of CFG Token. With strategic moves and a strong partner ecosystem, Centrifuge promises to continue to grow and open up many new investment opportunities in the DeFi space.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]