Cronos is a layer 1 blockchain developed and built by the cryptocurrency exchange Cryptocom with the goal of expanding the DeFi and metaverse ecosystem of the exchange.

So, what makes Cronos special? Let’s explore in the following article together with AZCoin.

What is Cronos?

Cronos is an open-source layer 1 blockchain developed by Crypto.com, a cryptocurrency exchange established in 2016 and based in Singapore. Built on the Cosmos SDK, Cronos enables interaction with other blockchains on Cosmos and is compatible with EVM.

Cronos is built on the open-source Ethermint project and utilizes the Inter Blockchain Communications (IBC) protocol. This enables quick conversion of smart contracts from EVM-based blockchains to Cronos, allowing it to interact and connect with other blockchains on the Cosmos network.

The deployment of Cronos aims to expand Crypto.com’s DeFi and metaverse ecosystem, providing developers with an easy way to migrate applications from Ethereum and other EVM-based blockchains to Cronos at a low cost and high speed.

What makes Cryptocom Coin unique

Blockchain CRO focuses on providing users with payment solutions, transactions, and financial services.

CRO owners can stake their coins on the Cryptocom Chain to act as a validator and earn transaction processing fees on the network. Additionally, CRO can be used to pay transaction fees on the Cryptocom Chain.

Within the Cryptocom Pay payment application, users can receive cashback of up to 20% by paying merchants in CRO and up to 10% by purchasing gift cards and making peer-to-peer transfers.

In terms of transaction use cases, the Cryptocom App allows users to earn token rewards for certain listed assets by staking CRO.

Furthermore, users can earn annual interest rates of up to 12% with Cryptocom Coins by staking them on the Cryptocom Exchange app or the Cryptocom Metal Visa Card.

Overall, CRO serves as a tool to support the goal of increasing global cryptocurrency adoption by Cryptocom. Therefore, the company continues to seek and develop new use cases, enabling users to leverage the power of cryptocurrencies to enhance control over their money, data, and identity.

Cronos Pros and Cons?

Key Benefits

- Earn attractive APY interest rates through staking on the exchange

- Enjoy reduced exchange fees

- Access syndicate events with 50% discounts on a range of cryptocurrencies

- Holding a set amount of CRO unlocks perks like increased staking interest rates

Disadvantages

- The high APY for staking raises concerns about the sustainability of the business model

- Limited utility for the coin beyond the Cryptocom ecosystem

How is Cryptocom Coin network secured?

CRO is built on Ethereum’s blockchain following the ERC20 compatibility standard. This means that Cryptocom Coin network is secured by the Ethash algorithm.

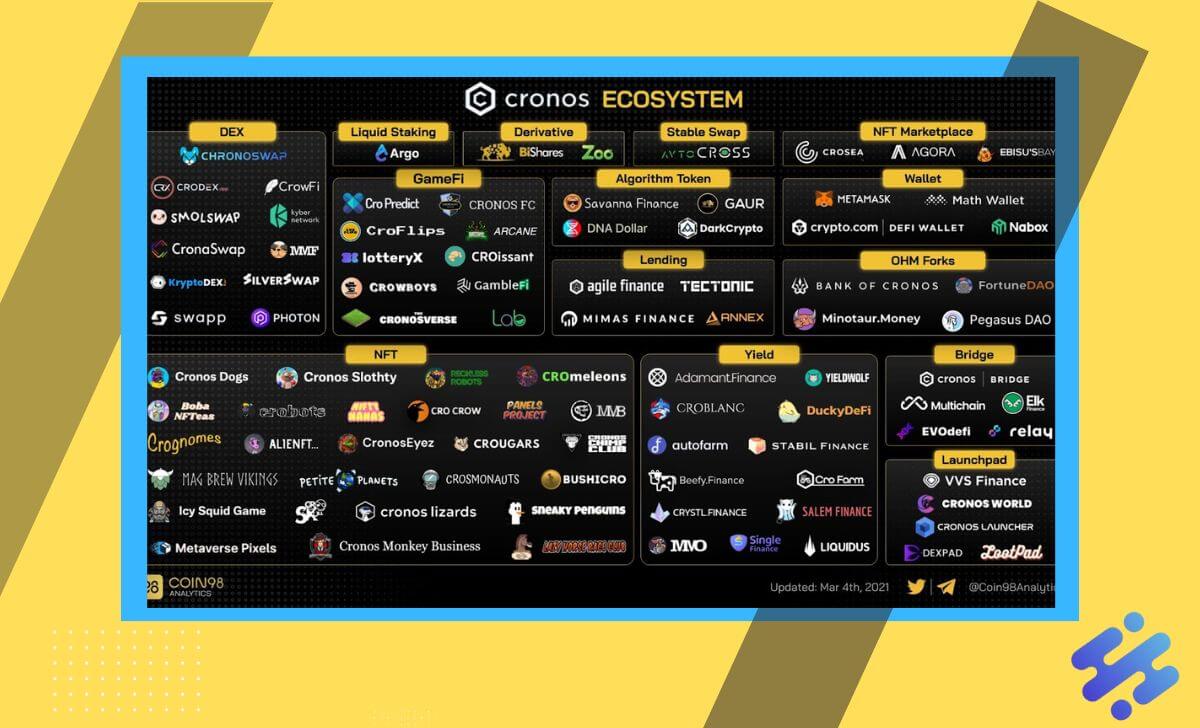

The Cronos ecosystem

Compared to its peak in April 2022, Cronos’ TVL has dropped by nearly 90%, from $3.2 billion to around $300-350 million and is maintaining stability around this level. The two DApps holding the most TVL in the Cronos ecosystem are VVS Finance with $185 million, a DEX platform present on Cronos since 2021, and Tectonic with $126.5 million, a multi-asset lending platform.

The components of the Cronos ecosystem are relatively well-developed, mostly focusing on the essential components of an ecosystem, which is DeFi. Additionally, NFTs, gaming, and metaverse are also concentrated components that are being developed to expand Cryptocom’s Web3 and metaverse ecosystem.

Cronos development Roadmap

In the future, Cronos plans to introduce new products to keep up with trends, focusing on improving protocols and enhancing Cronos’ interaction capabilities with both the Ethereum and Cosmos ecosystems such as deploying Rollup and Account Abstraction and more IBC bridges.

Development Team Cronos was founded and developed by leaders of Cryptocom, including:

- Kris Marszalek (CEO Co-founder): Former COO at Ensogo and founder of BEECRAZY, sold for $21 million to iBuy Group in 2013.

- Rafael Melo (CFO Co-founder): With 15 years of financial experience, he has expertise in mobile payments in Asia.

- Gary Or CTO (Co-founder): With over 9 years of programming experience and a keen interest in machine learning and artificial intelligence. He has worked in organizations like Foris, EventX, Stepcase.

- Bobby Bao (Co-founder and Managing Director of Crypto.com): Capital With extensive experience in investment banking, business development, investor relations, and listed in Forbes Asia’s Under 30 young leaders list in 2018. He has also served as Group Head at Ensogo, an investment banker at China Renaissance, Deloitte, Merrill Lynch.

Tokenomics

Token metric

Tokenomics refers to the study of the token metrics and characteristics of a cryptocurrency. The token metric for Cronos is denoted by the symbol CRO and operates on the Ethereum blockchain with the contract address 0xa0b73e1ff0b80914ab6fe0444e65848c4c34450b. The total supply of CRO tokens is 30,260,000,000.

Previously known as Crypto.org Coin, CRO was the native token of the Cryptocom exchange, similar to Binance’s BNB and OKX’s OKB. In February 2022, Cryptocom decided to rebrand this token as Cronos, making it the official token of the Cronos blockchain.

Token allocation ratio

- Secondary Distribution and Launch Incentives: 30%

- Capital Reserve: 20%

- Network Long-Term Incentives: 20%

- Ecosystem Grants: 20%

- Community Development: 10%

Token use cases

The CRO token is used for:

- Making payments, transactions, and accessing services on Crypto.com

- Staking on the Cryptocom chain to receive rewards and pay transaction fees on the Crypto.com chain

- Enjoying reduced trading fees on the Cryptocom exchange when staking CRO or selecting CRO as the currency for payment.

Frequently Asked Questions about CRO token

Where can I purchase CRO coins?

CRO can be bought on various exchanges such as Huobi and KuCoin, but the most recommended place to buy CRO is directly from Cryptocom’s own exchange.

You can check reviews of reputable crypto exchanges through the best crypto exchanges 2024 page on the website and choose to trade various types of coins such as toncoin, dogecoin, tron,…

How does Cryptocom generate revenue?

Cryptocom profits by collecting transaction fees from its diverse range of cryptocurrency products, primarily focused on payments.

Is it possible to receive interest in my CRO?

By staking CRO in either Crypto Earn or Cryptocom’s exchange, you have the opportunity to earn up to 12% APY on your investment.

Summary

Through the overview of the Cronos project in this article, AZCoin hopes that readers will grasp basic information about this project to make their own investment decisions. If you have any questions about CRO, please feel free to leave a comment or contact us through the information on the contact page.

I am Tony Vu, living in California, USA. I am currently the co-founder of AZCoin company, with many years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]