Demand for Bitcoin has been on a steady decline since April, nearing negative levels in recent weeks.

An August 20 report from data analytics firm CryptoQuant reveals that apparent demand for Bitcoin has dropped significantly, from a 30-day growth of 496,000 BTC in April to a negative growth of 25,000 BTC currently. This apparent demand is calculated by subtracting the daily total Bitcoin block subsidy from the daily change in the amount of Bitcoin that has remained untouched for one year or longer.

This decline in demand has, as expected, had a negative impact on Bitcoin’s price. The price of Bitcoin has fallen from around $70,000 in April to a low of about $51,000 in early August. Despite this correction, Bitcoin still shows a 33% return year-to-date as of the time of writing.

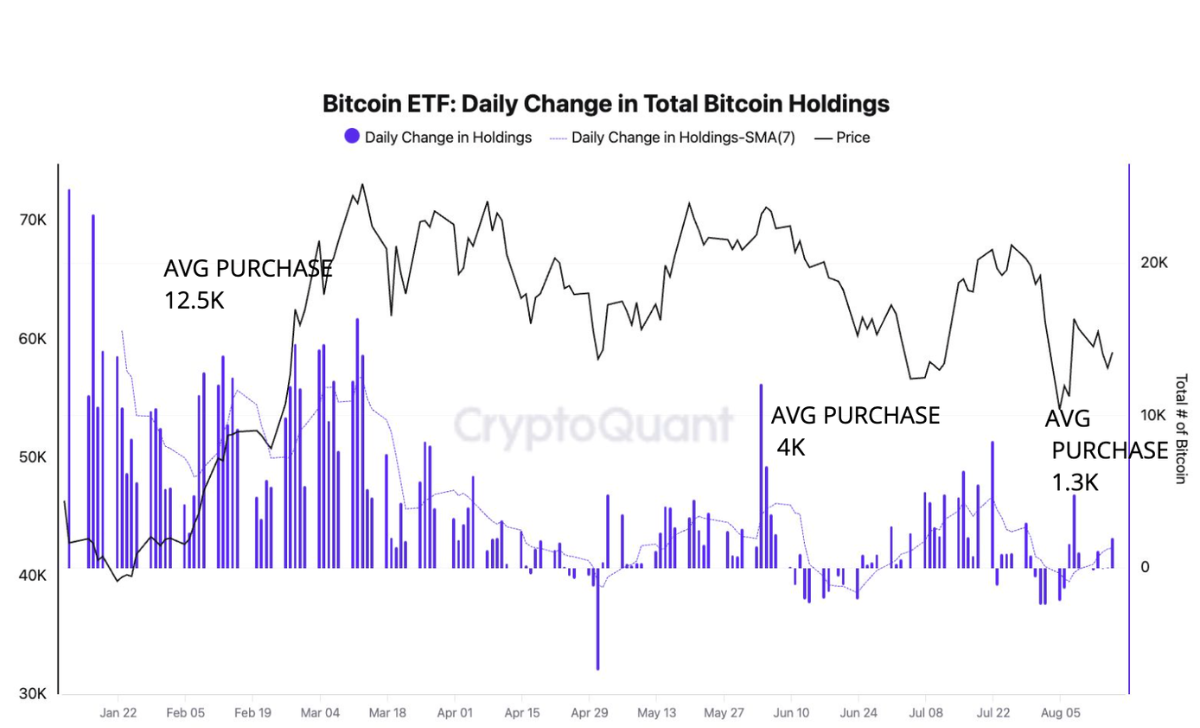

The decrease in demand is partly attributed to a significant drop in purchases by U.S. spot exchange-traded funds (ETFs), which have decreased from 12,000 BTC in March to an average of just 1,300 BTC between August 11 and August 17.

Daily change in total Bitcoin holdings

The price premium for BTC trading on Coinbase hit 0.25% in early 2024, following the launch of these ETFs. However, the premium has since declined to 0.01%, further indicating reduced demand for Bitcoin in the U.S.

The analysis suggests that a recovery in spot ETF purchases is crucial for boosting overall Bitcoin demand, which could potentially lead to a price rally.

On the other hand, long-term Bitcoin holders have been increasing their positions, taking advantage of the lower prices. The total balance of permanent holders – addresses that have never spent or sold Bitcoin – is growing at a record-high monthly rate of 391,000 BTC. The report notes that demand from these permanent holders is rising even faster than it did in Q1 2024, when Bitcoin’s price surpassed $70,000.

Read more: German Regulator Targets Crypto ATMs

Meanwhile, whale addresses – those holding between 1,000 and 10,000 BTC—have been reducing their total holdings. The analysis shows that the 30day percentage change in whale holdings has dropped from 6% in February, the fastest pace since February 2019, to just 1% currently. Historically, a monthly growth rate above 3% in whale holdings has been correlated with rising Bitcoin prices.

Cre: cointelegraph.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]