Drift Protocol is one of the standout decentralized exchanges (DEX) currently available on the Solana blockchain. It employs advanced mechanisms and provides a broad range of financial products for its users.

This article by AZCoin will deliver a comprehensive overview of Drift Protocol, discussing its products, the Drift token’s potential and key insights about its development team and investors.

What is Drift Protocol?

Drift Protocol is one of the most advanced DEX currently available, built on the Solana blockchain. It stands out by utilizing the Dynamic Automated Market Maker (Dynamic AMM) mechanism, an enhanced version of the traditional AMM model, offering higher capital efficiency and reducing slippage in trades.

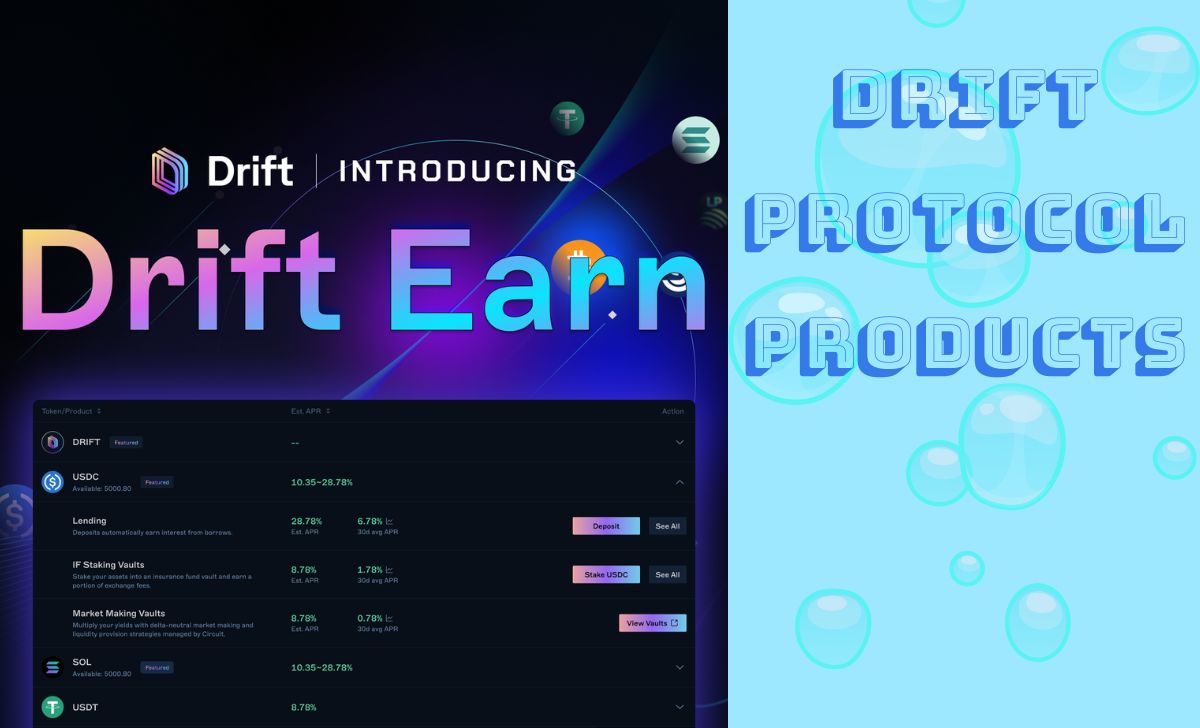

Drift Protocol products

Drift Protocol offers a range of products and services to meet users’ trading and investment needs. Let’s take a closer look at some of its key offerings:

Spot Trading

A core feature of any exchange. On Drift Protocol, users can buy and sell digital assets such as SOL, mSOL, wBTC, wETH, USDT, USDC and many others quickly and efficiently. The platform supports various order types, including market orders, limit orders and stop-loss orders, providing traders with flexibility in managing risk and optimizing profits.

Derivatives Trading

Derivatives trading is one of the standout features of Drift Protocol, allowing users to trade futures contracts with leverage up to 20x. This presents an opportunity for higher profits but also comes with increased risk. Drift supports trading of popular assets like BTC, ETH, SOL, APT, MATIC and several other tokens, offering a professional and secure trading environment for users.

Token Swap

The Token Swap feature on Drift Protocol enables users to quickly convert between different tokens, including SOL, mSOL, wBTC, wETH, USDT and USDC. Drift utilizes the Dynamic AMM mechanism to ensure users receive the best price and reduce slippage costs during swaps.

Lending and Borrowing

Another noteworthy product of Drift Protocol is the lending and borrowing feature. Users can deposit their assets into liquidity pools to earn interest, while borrowers can use assets like mSOL, USDC and USDT as collateral. This system helps increase the platform’s liquidity and provides attractive returns for participants.

Drift Liquidity Provision (DLP)

Drift Protocol offers users the opportunity to become liquidity providers through the Drift Liquidity Provision (DLP) program. By participating in DLP, users can earn rewards based on trading fees and other incentives from the Drift ecosystem. This is an effective way for users to leverage their assets to generate passive income.

Key features of Drift Protocol

Drift Protocol has several unique features that differentiate it from other decentralized exchanges in the market:

Dynamic AMM Mechanism

The Dynamic AMM (DAMM) mechanism is one of the most prominent features of Drift Protocol. Unlike traditional AMMs, DAMM adjusts liquidity in pools dynamically based on market demand, optimizing capital efficiency. This not only reduces slippage but also provides a smoother trading experience for users.

Insurance Fund

Drift Protocol proudly maintains an internal insurance fund to protect users in the event of a mishap or asset loss due to unsuccessful liquidations. This insurance fund is funded through trading fees and a portion of collateral from liquidated trades. This adds safety and stability to Drift’s ecosystem.

Symmetrical Funding Rate

The Funding Rate is an essential factor in derivatives trading. Drift Protocol applies a symmetrical Funding Rate mechanism, balancing long and short positions in the market. If an imbalance occurs, the system automatically adjusts to ensure that the insurance fund isn’t excessively depleted while maintaining stability on the platform.

Keepers Network

The Keepers network plays a crucial role in the Drift Protocol ecosystem by ensuring liquidity and order execution efficiency. Keepers act as market makers, ensuring that user trades are executed quickly and at the best possible price, even when handling large orders.

Overview DRIFToken

What is DRIF Token?

DRIF Token is the official token of Drift Protocol, playing an important role in the operation and development of the ecosystem. This token is used in the payment of transaction fees, staking and liquidity provision. It also allows holders to participate in the governance of the protocol through voting mechanisms.

Key metrics DRIFT Token

- Token name: Drift Protocol

- Ticker: DRIFT

- Token Type: Governance

- Token standard: SPL

- Blockchain: Solana

- Contract: DriFtupJYLTosbwoN8koMbEYSx54aFAVLddWsbksjwg7

- Market cap: $154,608,658

- Circulating supply: 226,752,496

- Fully diluted market cap: $681,838,836

- Total supply: 1,000,000,000

- Volume 24h (21/09/2024): $25,020,229

DRIFT Token allocation

DRIFT Token is allocated according to a specific schedule as follows:

- 45% for staking rewards and liquidity incentives.

- 25% for the development team and strategic investors.

- 20% for reserves and protocol development.

- 10% for marketing and community expansion.

Where to buy DRIFT Token, which exchange?

Drift Token can be purchased on several best cryptocurrency exchanges, including DEX platforms such as Serum and Raydium or centralized exchanges like Binance and FTX. Users can trade DRFT with popular pairs such as USDC/DRFT or SOL/DRFT.

Which wallet is DRIFT Token storage?

Drift Token can be securely stored in various wallets compatible with Solana, including Phantom, Solflare, Ledger (hardware wallet) and Trust Wallet.

Project Team, Investors and Partners

Project Team

While the full details of Drift Protocol’s team have not been widely disclosed, according to AZCoin, the project is led by three key figures:

- @bigz_Pubkey: Head of R&D.

- Cindy Leow: Co-Founder and CEO.

- Cris Pheaney: CTO of the project.

Investors & Partners

Drift Protocol raised $3.8 million in its seed round in October 2021 from major investment funds, including Polychain Capital, Multicoin Capital, Jump Capital, Not3Lau Capital and Robot Ventures. These investors not only provide capital but also offer strategic and technological support for the project’s long-term development.

Is DRIFT Token a good investment?

Based on current information, Drift Token is an attractive investment option for those interested in the DeFi market and decentralized trading on Solana. With the support of large investment funds and innovative mechanisms such as DAMM, Drift Token has strong potential for future growth. In particular, the growth in TVL and trading volume shows the great interest of the community in this project.

Summary

Through this overview article about the Drift Protocol project, AZCoin hopes that you have a clearer view of Drift Token and the investment potential of this project. With many outstanding features and support from the community, Drift Protocol is one of the notable DeFi projects on Solana.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]