Asset manager Franklin Templeton has filed for approval to launch a new exchange-traded fund (ETF) that aims to serve as a comprehensive crypto portfolio, according to an August 16 filing. The proposed Franklin Crypto Index ETF will track the performance of the CF Institutional Digital Asset Index, which currently includes only Bitcoin and Ethereum.

The fund intends to mirror the weights of these digital assets as represented in the underlying index. The filing also indicates that the ETF could potentially include other cryptocurrencies in the future.

Read more: Pro-XRP Attorney Claims SEC’s Appeal Success Rate is Only 9%

As one of the early players in the emerging market for crypto index ETFs, Franklin Templeton’s offering will compete with the Hashdex Nasdaq Crypto Index ETF, the first crypto index ETF to seek regulatory approval.

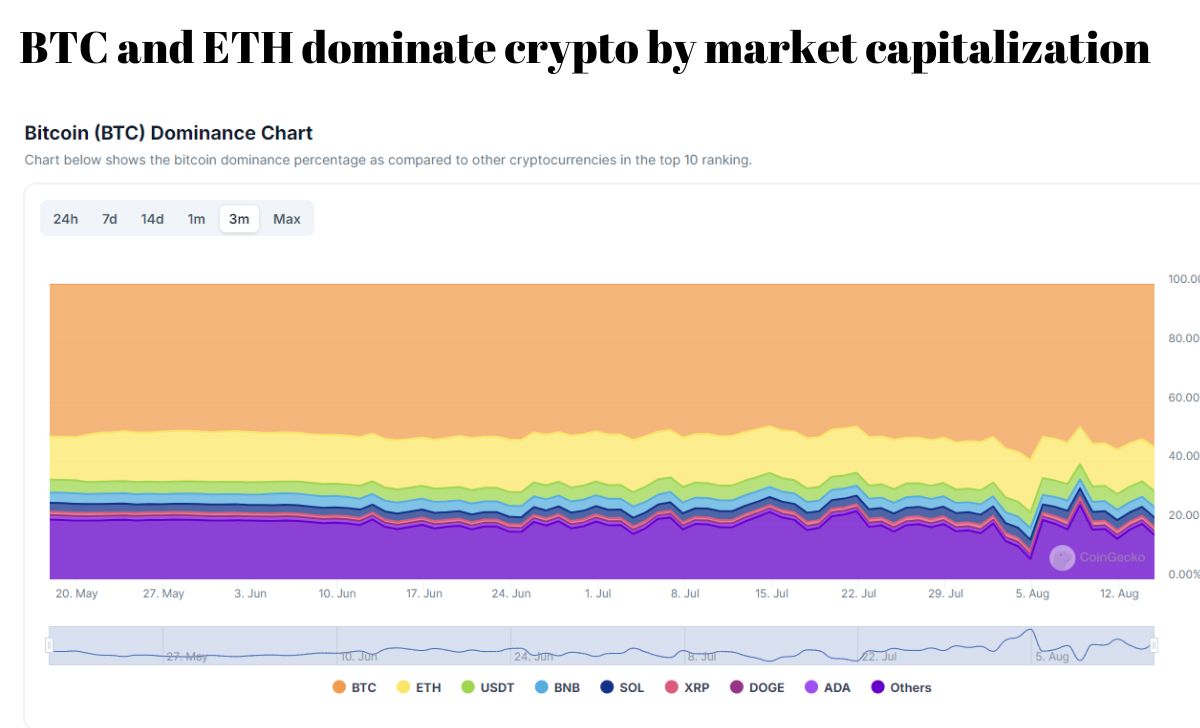

Katalin Tischhauser, head of investment research at crypto bank Sygnum, commented that index ETFs are a natural progression for investors, akin to how people invest in the S&P 500 through ETFs. However, current crypto index ETFs are limited to Bitcoin and Ethereum, the only digital assets approved by the Securities and Exchange Commission (SEC) for inclusion in such products.

Grayscale, the largest crypto fund issuer with $25 billion in assets under management, has also hinted at plans to enter the crypto index ETF space, expressing interest in developing more single-asset and diversified products.

Before the ETF can be listed on public exchanges like Nasdaq, the SEC must approve its registration application, known as an S-1.

Cre: cointelegraph

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]