Frax Shares is a platform that many investors are interested in thanks to its unique approach to stablecoins and decentralized financial products (DeFi). So why is Frax Shares considered one of the most prominent projects in the current crypto ecosystem?

The following article by AZCoin will help you better understand Frax Shares (FXS), its operating mechanism and the products that this platform provides.

What is Frax Shares (FXS)?

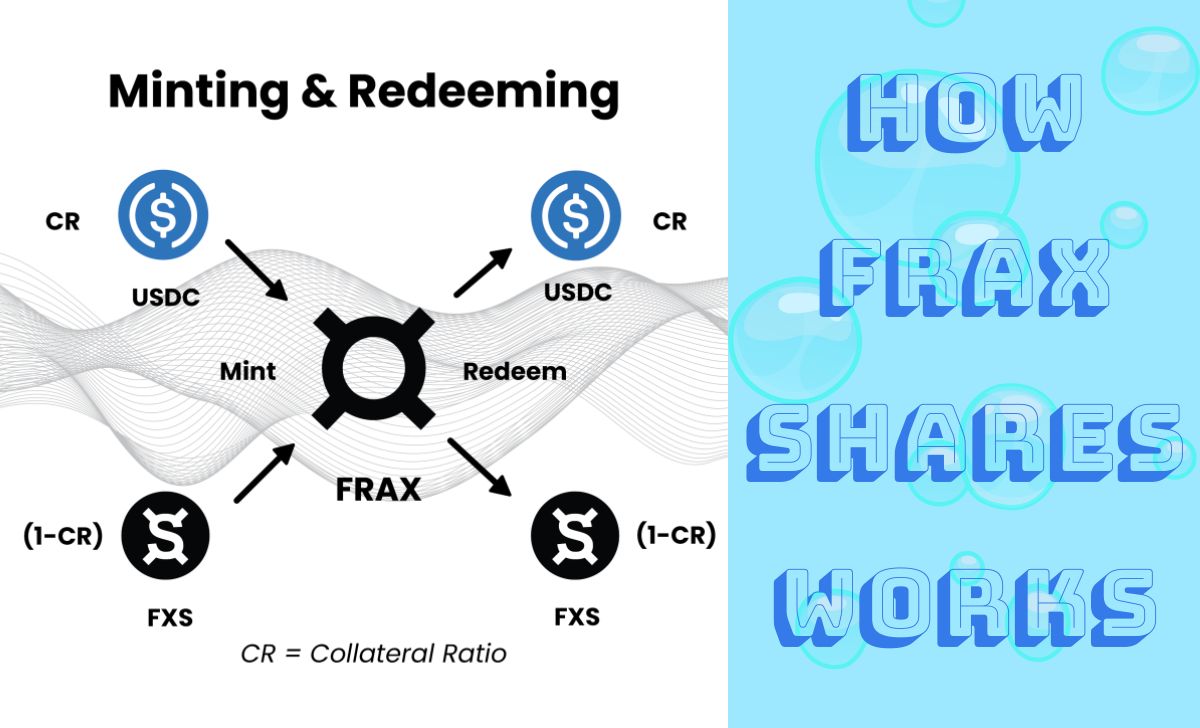

Frax Shares (FXS) is a specially designed stablecoin protocol with a “fractional algorithmic” model. It’s the world’s first stablecoin project that combines a collateralized mechanism with an algorithm that adjusts the collateral ratio over time. This means that Frax uses a portion of the collateral and the rest is adjusted algorithmically, based on market demand and supply.

Frax Shares is built on the Ethereum blockchain and this system has a unique feature that optimizes the price stability of the FRAX stablecoin. The Frax goal is to create a stablecoin ecosystem that is more stable and flexible than previous models, including those that are purely collateralized or purely algorithmic.

How does Frax Shares work?

Frax Shares works by combining collateral and algorithms to keep the price of the FRAX stablecoin stable around $1. When the price of FRAX exceeds $1, the protocol will reduce the collateral ratio, allowing more FRAX tokens to be issued. Conversely, if the price of FRAX falls below $1, the protocol will increase the collateral ratio to ensure that the token has a solid value.

Frax Shares products

Frax Shares not only provides a stablecoin but also develops a variety of products to optimize the potential use in different fields:

- FRAX Lend: A lending & borrowing protocol in the Frax ecosystem. Users can collateralize some assets to borrow FRAX and participate in lending activities. Currently, there are six types of assets that can be collateralized to borrow FRAX, helping to optimize liquidity and capital efficiency.

- FRAX Swap: An AMM for large swap orders. With Frax Swap, large transactions can be executed more efficiently, minimizing costs and slippage risks.

- FRAX Price Index & Share (FPI): FRAX Price Index is pegged to the consumer price index (CPI) to help users fight inflation. This is a pioneering approach, combining cryptocurrencies and traditional economic indicators.

- FRAX ETH: This is a product pegged to ETH, similar to WETH. Users can collateralize ETH into smart contracts and receive FRAX ETH (frxETH) in return. This helps users earn additional profits through staking FRAX ETH or using it in other protocols.

- Fraxferry: Is a cross-chain bridge specifically designed to solve security issues when moving assets between blockchain. With better control and management, Fraxferry helps reduce the risk of smart contract errors as well as hacker attacks.

- Algorithmic Market Operations (AMO’s): This is an important tool in maintaining the stability of the Frax protocol. It automatically adjusts the supply of FRAX stablecoins based on market factors and user demand.

Core features of Frax Shares

Frax Shares offers several important features that enhance the usefulness and sustainability of the system:

- Swap: Frax uses principles from large AMMs like Uniswap to build a price discovery mechanism when swapping tokens. This ensures that transactions are executed at the fairest and most efficient prices.

- Crypto Native CPI: Frax has developed a blockchain-based consumer price index, called the Frax Price Index (FPI). FPI helps users protect their assets from inflation in the real economy.

- Lending: With Frax Lend, users can participate in lending markets between any two ERC20 tokens. This opens up many opportunities for digital asset holders to earn profits.

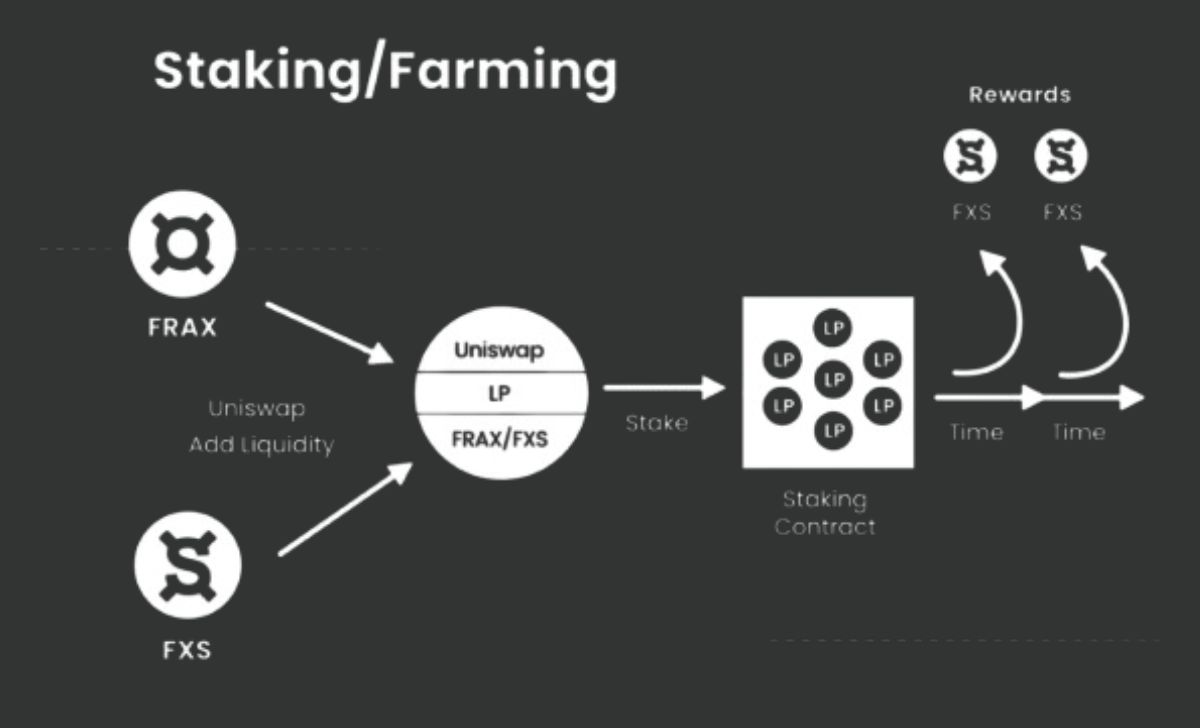

- Liquidity & Staking: Users can deposit tokens into liquidity pools and receive FXS rewards in return. Liquidity providers play an important role in providing liquidity to the Frax ecosystem.

- Buybacks & Recollateralization: When the protocol has excess collateral, it will buyback FXS to increase the value for FXS token holders. Conversely, when needed, Frax will add collateral to maintain the stability of FRAX.

Basic information about FXS coin

What is FXS coin?

FXS is the governance and utility token in the Frax Shares ecosystem. It’s used to participate in the governance and adjustment of protocol policies, as well as benefit from staking and buyback mechanisms.

Technical parameters

- Token name: Frax Shares

- Symbol: FXS

- Blockchain: Ethereum

- Token Standard: Erc-20

- Token Type: Governance & Utility

- Contract: 0x3432b6a60d23ca0dfca7761b7ab56459d9c964d0

- Market cap: $157,962,137

- Circulating Supply: 81,466,312 FXS

- Total Supply: 99,681,496 FXS

- Fully Diluted Market Cap: $193,278,042

- 24h Trading Volume (21/09/2024): $11,328,287

FXS coin allocation

The distribution ratio of FXS coin is divided as follows:

- 60% for Liquidity Providers and Farmers

- 20% for development team and advisors

- 10% for strategic investors

- The remaining 10% is for growing the Frax ecosystem.

FXS coin buying/selling exchange

Users can buy FXS on many best cryptocurrency exchanges, such as Binance, Coinbase, OKX, Kucoin, MEXC, Bybit, Uniswap, etc.

Which wallet stores FXS coins safely?

To store FXS coins securely, users can use software wallets like MetaMask or hardware wallets like Ledger, ensuring that your assets are always secure.

Project Team, Investors and Partners of Frax Shares

Project Team

- Sam Kazemian: A renowned software developer, co-founded Everipedia and has extensive experience in the blockchain space.

- Jason Huan: Co-founder and has deep knowledge of financial systems and technology.

Investors

The Frax major investors include Tribe Capital, Multicoin Capital, Galaxy Digital, Mechanism Capital, Parafi Capital. In total, 18 investors have joined the project, demonstrating great potential and trust from leading investment institutions.

Partners

The project has partnerships with many well-known organizations in the industry such as Olympus DAO, BSC, Ondo Finance, Avalanche and Uniswap, which helps increase the reputation and reliability of Frax Shares.

Conclusion

Through this article, AZCoin has helped you better understand Frax Shares (FXS) and its potential in the cryptocurrency ecosystem. With the strong development and investment opportunities that Frax brings, this can be a worthy choice for investors. Wish you success in learning more about Frax Shares!

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]