Grayscale Investments has launched a new investment fund focused on Avalanche’s native token, AVAX, as announced on August 22. The Grayscale Avalanche Trust provides investors with exposure to Avalanche, a three-chain smart contract platform designed to optimize scalability, network security and decentralization.

Avalanche is a layer-1 blockchain network specializing in the tokenization of real-world assets (RWA), such as real estate, commodities and fine art. On August 22, Franklin Templeton expanded its blockchain-integrated money market fund to include Avalanche.

Grayscale’s Avalanche Trust allows investors to participate in the advancement of RWA tokenization through Avalanche’s strategic partnerships and multi-chain structure, according to Rayhaneh Sharif-Askary, Grayscale’s head of product and research.

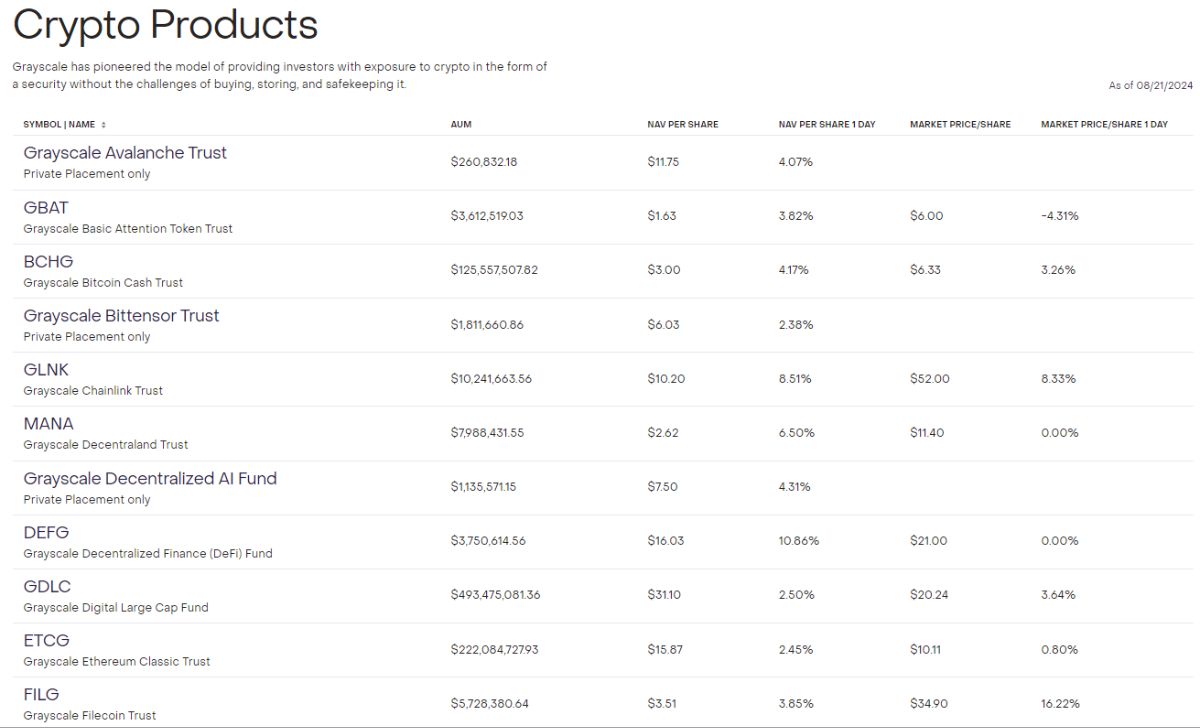

This new fund, available only to qualified investors and not exchange-traded, adds to Grayscale’s portfolio of over 20 crypto investment products. Earlier in August, Grayscale launched trusts for investing in MakerDAO’s MKR token, Bittensor’s native token, and Sui’s protocol tokens.

Read more: Anchorage Integrates PayPal Stablecoin Yield into Custody Platform

Grayscale, the world’s largest crypto fund manager with over $25 billion in assets under management, is renowned for its Bitcoin and Ether exchange-traded funds, including the Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE). It also manages private single-asset funds for other protocol tokens like Basic Attention Token (BAT) and Chainlink (LINK).

During an August 12 webinar, Dave LaValle, Grayscale’s global head of ETFs, forecasted that the market for cryptocurrency ETFs would expand to include new digital assets and diversified crypto indexes.

Cre: cointelegraph.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]