Argo Blockchain Completes Repayment of $35 Million Loan from Galaxy Digital

Argo Blockchain, a Bitcoin mining company, has successfully repaid a $35 million loan from Galaxy Digital. This loan, taken in 2022, was crucial in helping Argo avoid bankruptcy during the challenging crypto bear market. As part of the agreement, Argo sold its Helios Bitcoin mining facility in Texas to Galaxy Digital for $65 million and restructured its debt.

The loan was backed by Argo’s 23,619 Bitmain S19J Pro mining machines, which were operational at Helios, along with other machines located at Argo’s Canadian data centers. Argo also agreed to lease back space in the Helios facility to continue its mining operations.

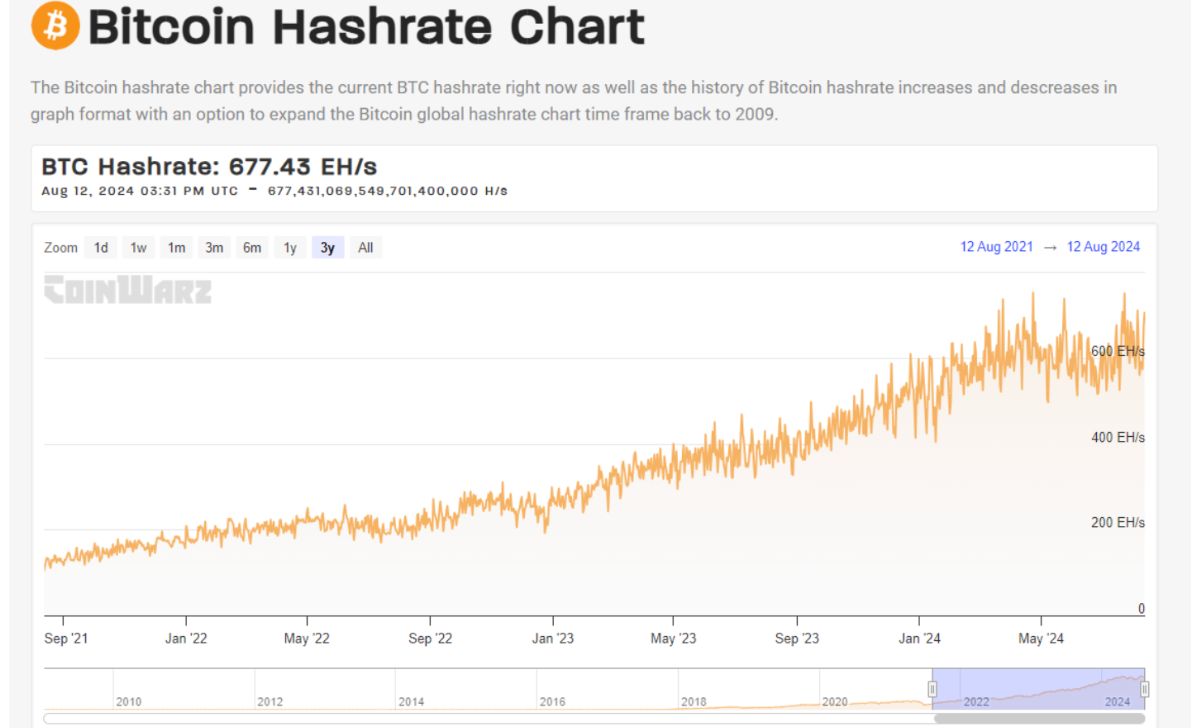

As of the end of 2023, Argo’s mining capacity was 2.7 exahashes per second (EH/s), while the total Bitcoin network hashrate stood at 677.43 EH/s, according to CoinWarz data. In July, Argo mined a total of 48 BTC, averaging 1.5 BTC per day.

The total hashrate for the Bitcoin network is currently 677.43 EH/s.

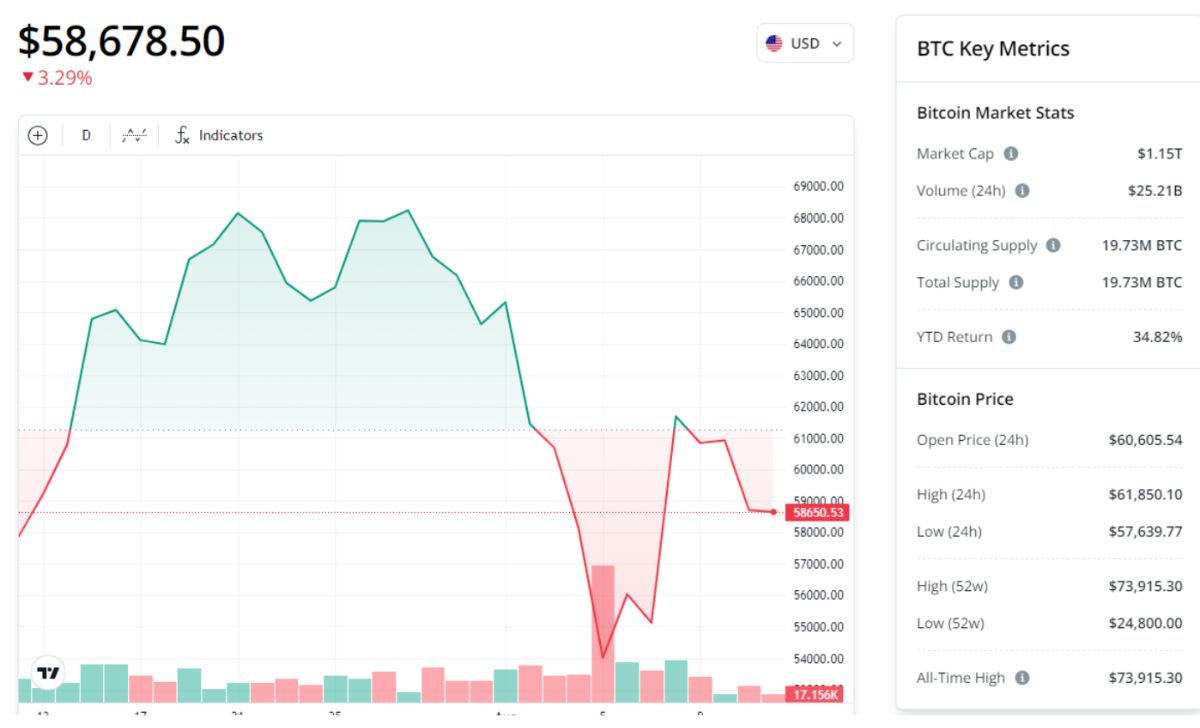

Bitcoin Price Decline Linked to Reduced Institutional Stablecoin Purchases

The price of Bitcoin has dropped below the significant psychological threshold of $60,000, coinciding with a slowdown in stablecoin accumulation by institutional investors over the last two days.

On August 12, Bitcoin’s price decreased by 3.9% to $58,930 as of 08:03 am UTC, retreating from a weekly high of $62,510.

BTC/USD, 1-month chart

According to an on-chain analytics platform, Lookonchain, institutions seem to have paused their stablecoin acquisitions, impacting Bitcoin’s price. Lookonchain noted that institutions ceased receiving USDT from Tether Treasury and transferring it to exchanges two days prior.

The absence of institutional stablecoin flows into exchanges suggests diminished buying pressure and interest in Bitcoin. Stablecoins serve as a primary bridge between fiat and cryptocurrencies, facilitating investment inflows.

Tether, the issuer of the world’s largest stablecoin, minted over $1.3 billion worth of stablecoins between August 5 and August 9, following the market downturn.

Read more: Here’s Why Trump Falls Behind Harris On Crypto Platform Polymarket: Expert

Crypto User Incurs $90,000 Gas Fee on $2,000 Ether Transfer

A crypto user mistakenly incurred $90,000 in gas fees for a routine $2,200 Ether transaction. According to Etherscan data, the user paid 34.26 Ether, valued at $89,200, to transfer 0.87 ETH, worth just $2,262.

Despite Ethereum network gas fees reaching yearly lows of 2 to 4 gwei, the user overpaid by a staggering 1,783,900%. This incident occurred even as Ethereum’s median gas fees hit a five-year low, reportedly dropping below 1 Gwei.

Cre: cointelegraph

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]