The U.S. Securities and Exchange Commission (SEC) has charged two brothers for allegedly running a $60 million crypto Ponzi scheme involving a non-existent crypto trading bot.

In a complaint filed on August 26 in the U.S. District Court for the Northern District of Georgia, Atlanta, the SEC claims that Jonathan Adam and his brother, Tanner Adam, deceived over 80 investors by promising a trading bot capable of delivering 13.5% monthly returns.

The SEC alleges that between January 2023 and June 2024, the brothers falsely claimed their bot could exploit arbitrage opportunities across crypto platforms, simultaneously buying and selling assets to capitalize on small price differences across markets. Investors were told their funds would be placed in a lending pool for flash loans and trades, with the assets borrowed and returned within the same blockchain transaction.

According to Justin Jeffries, Associate Director of Enforcement at the SEC’s Atlanta Regional Office, the trading scheme was entirely fraudulent, with no actual bot in existence. The SEC accuses the brothers of misappropriating $53.9 million of the $61.5 million raised. While some investors received returns, most of the funds were reportedly used to finance lavish lifestyles, including the purchase of vehicles and the construction of a $30 million condominium.

“As alleged, the Adam brothers promised investors high returns on a non-existent crypto investment, using their funds for Ponzi-like payments and personal luxury purchases” said Jeffries.

Read more: Bitcoin Millionaires Double Amid Crypto Rally

To stop the scheme, the SEC has secured emergency asset freezes on the brothers’ companies, GCZ Global, LLC and Triten Financial Group LLC. The SEC also claims Jonathan Adam misrepresented his background, failing to disclose three prior convictions for securities fraud, while falsely assuring investors that the risk was virtually nonexistent barring a global market meltdown.

The SEC has charged Jonathan and Tanner Adam with violating federal securities laws’ antifraud provisions and seeks permanent injunctions against their companies, the return of investor funds and civil penalties.

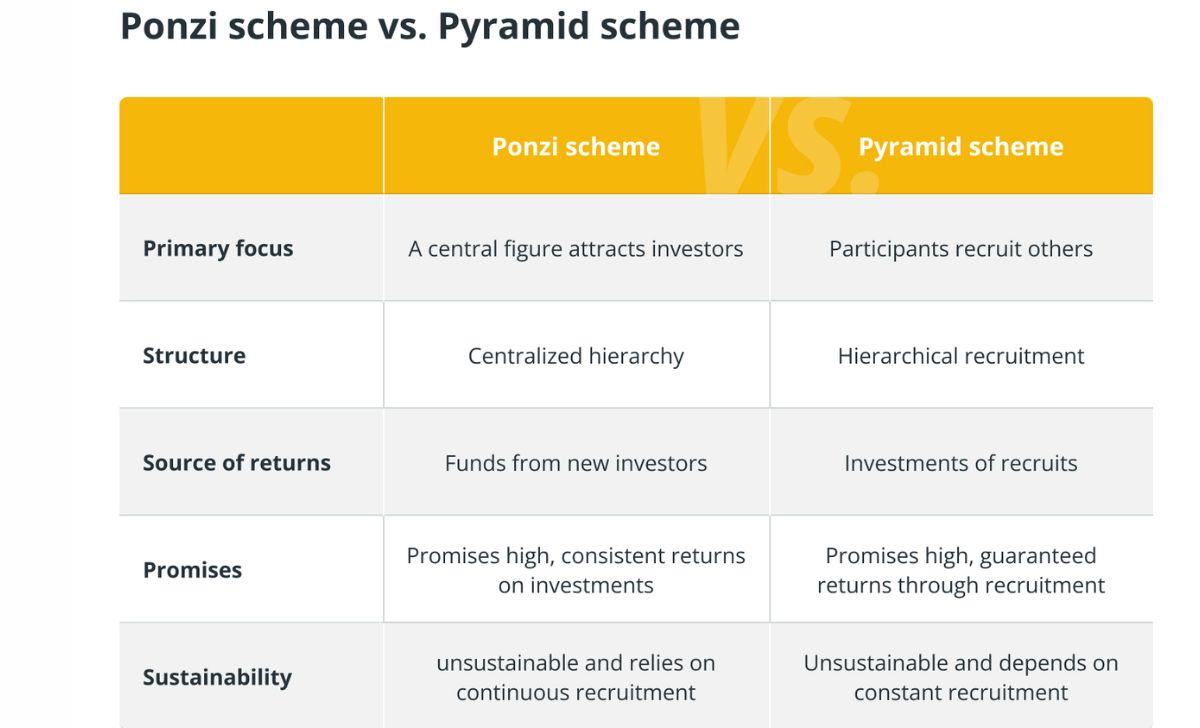

In June, blockchain intelligence firm TRM Labs reported that $7.8 billion was paid into cryptocurrency pyramid and Ponzi schemes globally in 2022.

Cre: cointelegraph.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]