The stablecoin market capitalization has reached a record high of $168 billion, marking 11 months of continuous growth. Data from DefiLlama reveals that this new peak surpasses the previous high of $167 billion set in March 2022.

This figure excludes algorithmic stablecoins, which use algorithmic mechanisms to maintain value rather than being pegged to external assets such as fiat currencies or gold.

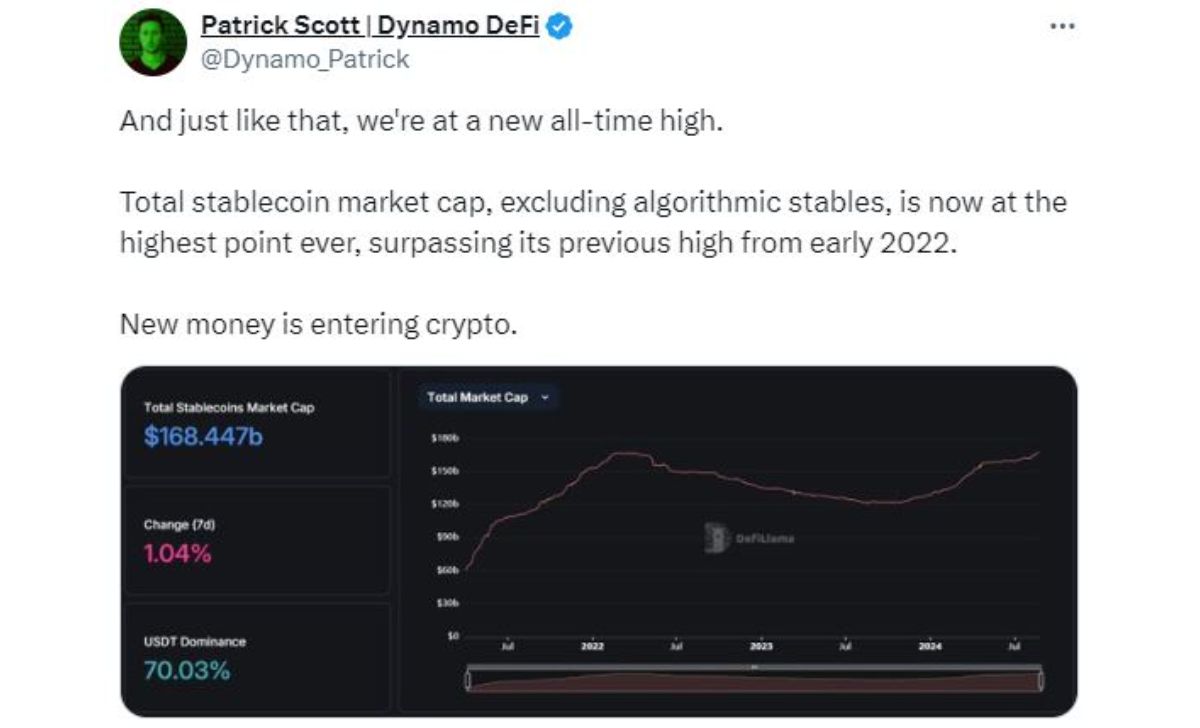

In March 2022, the stablecoin market hit an all-time high but fell to $135 billion by the end of that year. Crypto analyst Patrick Scott, known as “Dynamo DeFi,” suggested in an August 26 post on X that this growth indicates “new money is entering crypto.”

Cre: ETH Surges 6X Months After Major Ethereum Foundation Sale, Says Arkham

Scott noted that the stablecoin market cap, excluding algorithmic stables, has now exceeded its previous record from early 2022. He didn’t speculate on the cause of the increase but observed that “retail has been involved for at least eight months,” when asked about potential institutional investment.

Leading the stablecoin market is Tether (USDT), which began the year with a market cap of $91.69 billion and reached over $117 billion in August. Circle’s USD Coin (USDC) also saw growth, achieving a market cap of over $34 billion in 2024, though it remains below its peak of $55.8 billion in June 2022.

According to a July report by CCData, stablecoin trading volumes dropped by 8.35% to $795 billion due to reduced trading activity on centralized exchanges. The report cites MiCA regulations and concerns about the future of USDT in Europe as factors contributing to this decline.

The downward trend in trading volume has continued into August, with the market’s trading volume currently just above $46 billion, as reported by CoinMarketCap.

Cre: cointelegraph

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]