The emergence of P2P Lending has created a new trend in investment thinking in the 4.0 era, especially in the field of finance and technology.

So what is P2P Lending? What advantages does this form have that attract investors so much? All will be answered in the article below from AZCoin.

What is P2P Lending?

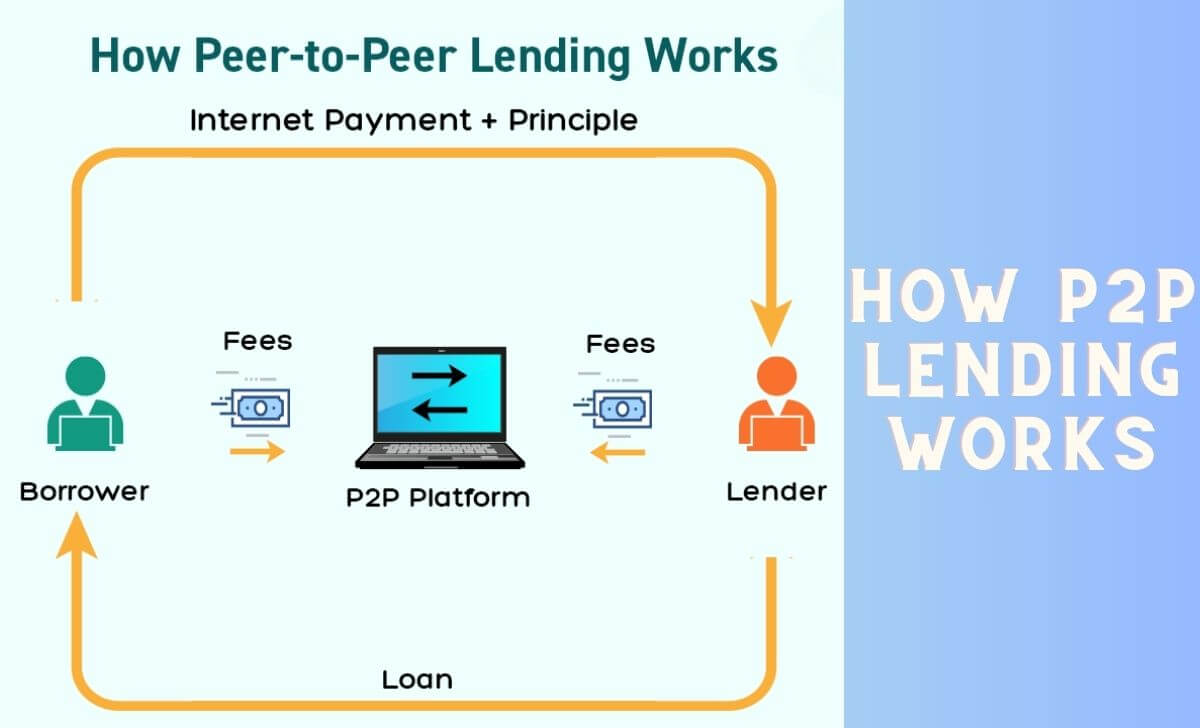

P2P Lending (also known as Peer to Peer Lending) is a lending model based on digital technology, where borrowers and lenders (investors) will be connected directly to each other without having to go through any traditional credit institution or bank.

In particular, the responsibilities of the participants in a P2P Lending deal will comprise:

- P2P lending website: is a platform that directly connects borrowers with lenders (or investors), represented by a P2P Lending service provider. This company will be responsible for searching, evaluating and appraising loan applications, and is also responsible for collecting loans when due, ensuring interest and principal for investors.

- Borrowers: are those who are looking for an alternative to traditional loans, either because they are stuck with administrative procedures or because they expect a better interest rate than bank loans.

- Lenders: are individual investors who want to receive income from idle money, with the expectation of getting better returns than bank savings and more sustainable than other investment channels.

It can be seen that the birth of peer-to-peer lending (P2P Lending) is an effective and innovative solution for traditional lending and financing activities, helping people’s money to circulate, giving them peace of mind in their daily lives and production.

History of P2P Lending

P2P Lending first officially launched in the UK in 2005, with the pioneering launch of the Zopa platform. Funding Circle followed in August 2010.

The main purpose of these platforms at that time was to provide loans to individuals and small businesses, which were not receiving credit support from banks at that time.

To date, there have been hundreds of large and small P2P Lending platforms worldwide, with estimated transaction values of billions of dollars per year.

In the US, the peer-to-peer lending model began to develop in February 2006 with two typical names: Prosper and LendUp. According to LendUp’s statistics, this company has issued 117,412 loans with an amount of $151,256,0075; meanwhile, Prosper is not far behind when it issued 63,023 loans equivalent to an amount of up to $433,570,651.

In the Chinese market, there are prominent names such as: CreditEase, Lufax, Tuandai, China Rapid Finance and DianRong. Some statistics show that every year CreditEase has up to 500,000 loans equivalent to 3.2 billion dollars, growing 200%/year. In August 2016, all peer-to-peer lending companies in the world’s most populous country had a revenue exceeding 191 billion yuan (about 29 billion USD).

P2P Lending has developed rapidly in many countries around the world, but it has failed in the Chinese market. The changes in the way it operates have caused the Chinese government to increase strict measures and tighten the operations of P2P Lending companies.

Interested in exploring the realm of cryptocurrency exchanges? Dive into our the best crypto exchanges 2024 page for insider knowledge and expert insights.

How P2P Lending Works

With the P2P Lending model, borrowers and lenders are connected directly through service-providing websites. Terms and conditions are clearly disclosed, in which the peer-to-peer lending interest rate is set based on the creditworthiness of the borrower’s profile.

A borrowing and lending process through the P2P Lending model will take place sequentially in the following steps:

- Step 1: The lender (Investor) will open an investment account on the connecting unit’s website and deposit money into the account.

- Step 2: Similarly, the Borrower also opens a loan account on the connecting unit’s website, registers financial records and waits for approval.

- Step 3: The financial unit will use technology to evaluate and score the investor and borrower’s profiles.

- Step 4: After the application is successfully approved:

- Borrowers can request the loan they want, they can split the loan and borrow from different people.

- Investors will review and select partners who need to borrow through the available profiles on the system. Investors can also allocate funds into multiple amounts and provide capital to multiple people.

- Step 5: The borrower receives the loan. When the disbursement period comes, the borrower will pay the principal and interest to the investor. All operations are performed and processed right on the online platform of the connecting unit, which is extremely convenient.

If you’ve got some spare moments, why not dive into the captivating world of these other incredible resources we’ve handpicked just for you, like What is GameFi?, What is a Smart Contract?, Retik Finance,…

P2P lending benefits?

For borrowers

Through peer-to-peer lending, people who do not have access to traditional lending methods will have the opportunity to find affordable sources of funding because:

- P2P Lending offers lower interest rates of only 1.5%-2%/month

- Flexible loan packages according to needs: short-term, long-term, installment, salary-based loans, etc.

- Simple procedure, no hassle, no paperwork mortgage

- Easy to use, manage loans and pay online anytime, anywhere

- Quick disbursement within 24-48 hours after being granted a limit

For lenders (investors)

Difference creates attraction, peer-to-peer lending model (P2P Lending) minimizes the disadvantages that other traditional investment channels currently have. With P2P Lending, investors can complete:

Online trading, investing anywhere

Based on the 4.0 technology platform, P2P Lending helps optimize time and minimize costs for investors. In addition, technology is also applied to evaluate and verify the quality of borrowers, helping investors feel secure in making a profit from their idle money.

Investors can freely choose approved loan profiles that are continuously updated on the system, track credit history as well as detailed data on principal and interest after each disbursement with just a few clicks on a smart device.

Enjoy attractive interest rates with P2P

In the context of the economy entering a new normal phase after the Covid-19 pandemic, interest rates at banks are still very low, not attracting investors. With interest rates of only 5-6%/year, people are witnessing a large shift of idle cash flow from money storage channels to profitable investment channels such as stocks, real estate, and especially peer-to-peer lending (P2P Lending).

However, compared to traditional financial solutions, investing through the P2P Lending model brings much more attractive profits, from 15-20%/year depending on the connecting unit. The above profit level is equivalent to the expected profit of professional investors on the stock market, and is 2-3 times higher than current bank interest rates.

Simple procedure

Instead of having to constantly monitor market information and indexes, painstakingly research investment strategies such as stocks or have to do complicated legal paperwork such as real estate, now thanks to the application of modern technology, the P2P Lending model has shortened the time for document preparation as well as investment and lending procedures.

Investors only need to choose a loan application available on the system. All reports on investment status will be regularly updated by connected units to help investors easily grasp and manage finances effectively.

Easy to participate with small capital

Many people think that profitable investment requires a large amount of capital. It will be very difficult to find an investment channel starting with a small amount of capital. However, the birth of P2P Lending has created a new “playground”, helping everyone to participate in investing economically and intelligently.

As long as you have the right investment strategy, money will still generate regular profits, “interest on interest”, even if you have a modest amount of capital.

Epilogue

In the article above, AZCoin has provided you with comprehensive knowledge about P2P Lending.

Ensure that you completely grasp these risks and evaluation process procedure prior to making any investment choices. We hope this information will be truly beneficial to you, enabling you to assess and select the investment option that suits you best.

I am Tony Vu, living in California, USA. I am currently the co-founder of AZCoin company, with many years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]