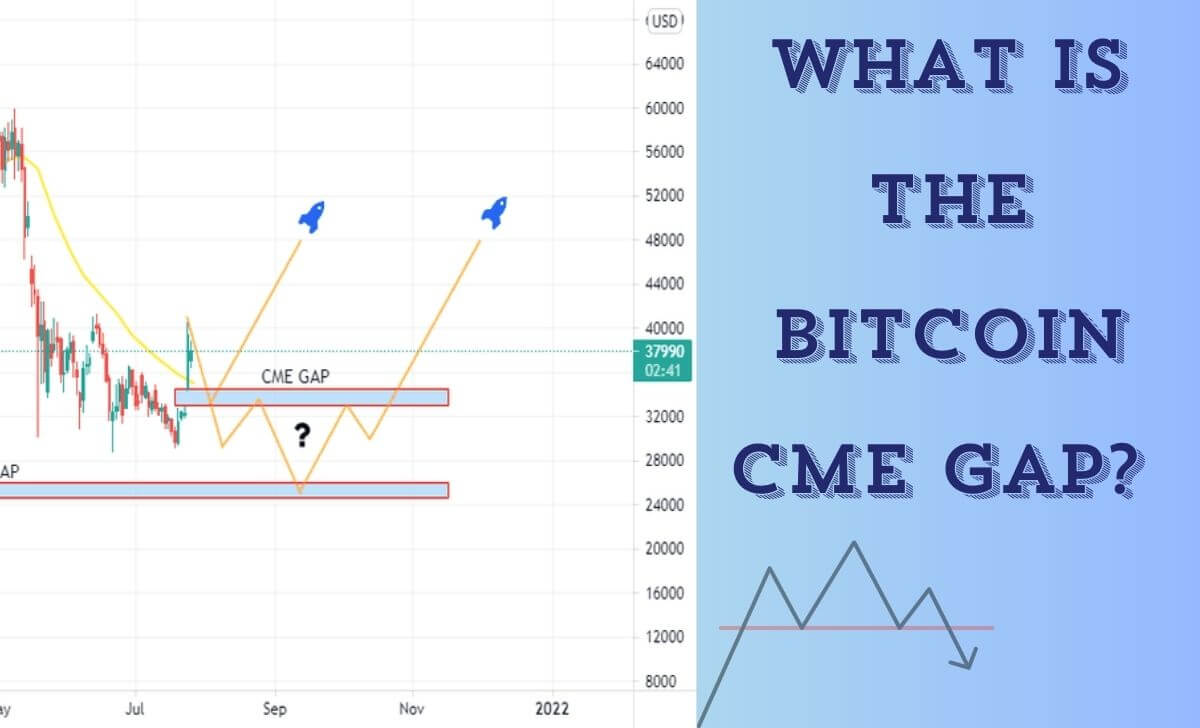

Bitcoin CME gap is one of the important factors that traders often pay attention to when analyzing the Bitcoin market. This gap appears due to the difference between the Bitcoin price when the CME market closes and reopens.

Understanding the Bitcoin CME gap and how to trade it can help you optimize your investment strategy. For more details, follow the AZCoin article.

What is the Bitcoin CME gap?

Bitcoin CME gap is the difference between the price of Bitcoin when the Chicago Mercantile Exchange (CME) market closes over the weekend and the price of Bitcoin when the market reopens at the beginning of the week. Since the CME only operates from Monday to Friday, the price of Bitcoin on the CME may differ from the price on other exchanges, especially on weekends.

Types of CME gap

There are two main types of CME gap that traders should be aware of:

- Burst CME gap: These are gap that occur when the CME opens higher than the previous close. They indicate that there is optimism in market sentiment and could lead to a future uptrend.

- Bottom CME gap: Conversely, a bearish CME gap occurs when the CME opens lower than the previous close. This could reflect pessimism in market sentiment and could lead to a future downtrend.

Reason for the formation of Bitcoin CME gap

There are several main reasons for the Bitcoin CME gap:

Difference in trading hours

CME trades during US business hours, while cryptocurrency exchanges operate 24/7. This difference can lead to significant changes in Bitcoin prices during the time the CME is closed.

When the CME reopens, Bitcoin prices may have changed significantly, creating a gap between the opening price and the previous closing price.

Investor sentiment

Investor sentiment can be significantly influenced by news events or special occurrences, such as the Bitcoin Halving, leading to substantial fluctuations in Bitcoin prices.

Derivatives market

Derivatives investors can use Bitcoin futures contracts as hedging or speculators. Their actions can affect Bitcoin prices and create a CME gap.

If many investors predict that Bitcoin prices will increase or decrease, they may make large trades on CME, leading to the formation of a gap.

Liquidity

The Bitcoin market on CME is typically less liquid than other cryptocurrency exchanges. Therefore, large buy or sell orders can impact the price of Bitcoin on CME, creating a CME gap. When there are few participants in the trade, a large order can cause strong volatility and create a gap between prices.

Benefits and risks of trading Bitcoin CME gap

Benefits

- Profit opportunity: Traders can use price retracements to “fill” the gap, creating a profit opportunity if they predict the price trend correctly.

- Trend prediction: Understanding Bitcoin CME gap can help predict important support and resistance levels, which can aid in building a trading strategy.

- Risk management: Understanding gap helps you identify more effective entry and exit points, thereby managing risk better.

Risks

- Inaccurate predictions: Prices don’t always return to fill the gap and incorrect predictions can introduce financial losses.

- High volatility: Trading based on gap can lead to high volatility and risk of loss without proper risk management strategy.

- News impact: News or special events can change market sentiment and cause gap to not be as accurate as originally predicted.

How to trade Bitcoin CME Gap

There are many ways to trade Bitcoin CME gap, here are 3 popular ways:

Arbitrage trading

This is buying Bitcoin at a low price on one exchange and selling Bitcoin at a high price on another exchange. Traders can take advantage of the CME gap to make arbitrage trades between CME and other cryptocurrency exchanges. When a CME gap is detected, traders can quickly execute trades to profit from the price difference.

Fill Gap

Prices tend to move back to fill this gap. If the opening price on Monday is lower than the closing price on Friday, you can place a buy order (long) and take profit when the price returns to the closing price on Friday.

Gap up

If the opening price on Monday is higher than the closing price on Friday, you can place a sell order (short) and take profit when the price returns to the closing price on Friday.

By integrating Proof of Stake (PoS) insights and maintaining robust risk management practices, traders can better navigate the complexities of trading Bitcoin CME gaps.

Should you trade based on the Bitcoin CME Gap?

Trading Bitcoin CME gap can be beneficial in predicting price trends and identifying support and resistance levels. However, gap aren’t always filled and the time to fill can vary from a few hours to a few weeks.

Therefore, using this strategy should be combined with other technical analysis and a strict risk management strategy. Traders should consider carefully and should not rely solely on the CME gap without considering other market factors.

For the best platforms to implement these strategies, AZcoin – best crypto exchange 2024 – offers advanced tools and resources to enhance your trading approach.

Note when trading Bitcoin CME gap

Above are some notes when trading Bitcoin CME gap:

- Closely monitor Bitcoin price charts and market news.

- Use indicators like RSI and MACD to determine market trends and momentum, helping you make more accurate trading decisions.

- Always place stop-loss orders to protect capital in case the market moves against your prediction.

- Do not put too much capital into a single trade. Reasonable capital allocation helps to minimize risks.

- Avoid over-trading based on emotions. Stick to your trading strategy and plan.

Conclusion

Hopefully this article has given you an overview of the Bitcoin CME gap, from basic concepts to trading strategies. Wish you success in applying this knowledge to Bitcoin trading and achieving the best results!

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]