Recent data reveals that Bitcoin investors have shifted back to a sentiment of greed following BTC’s surge to $64,000. Here’s what this shift could imply.

Bitcoin Fear & Greed Index Shows ‘Greed’ Sentiment

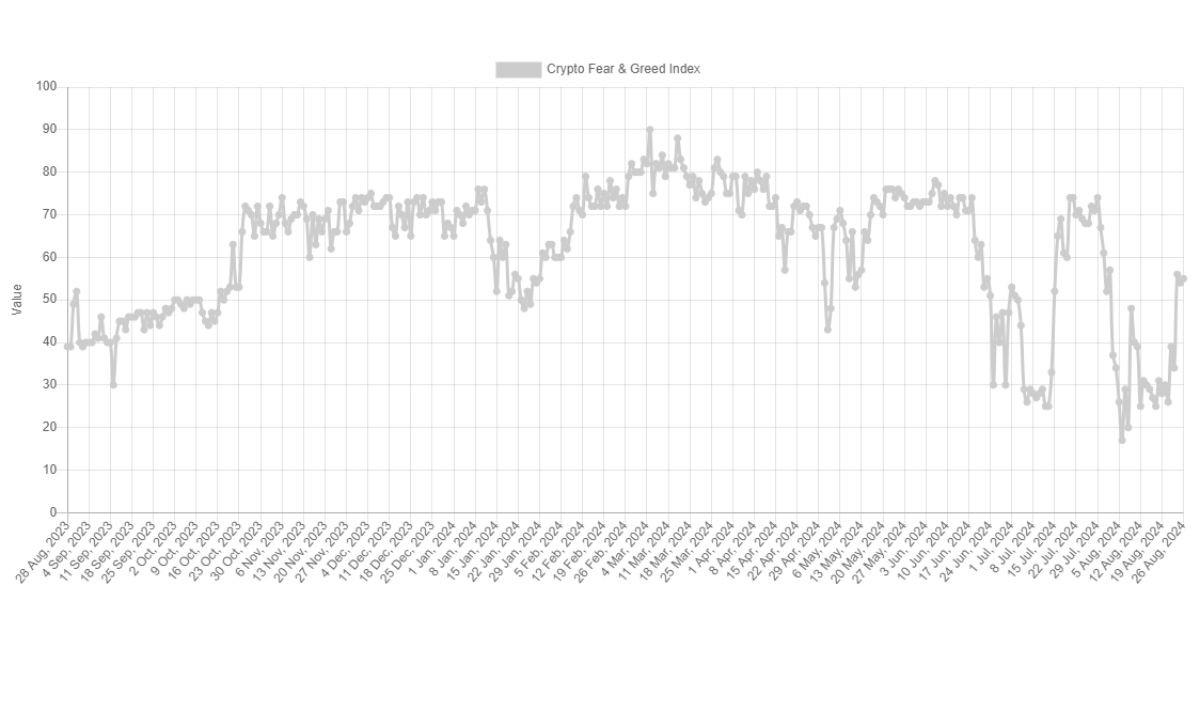

The “Fear & Greed Index”, created by Alternative, measures the current sentiment among Bitcoin and other major cryptocurrency investors. This index derives its value from five key factors: volatility, trading volume, social media sentiment, market cap dominance and Google Trends.

The index ranges from zero to one hundred, with values above 53 indicating greed, while values below 47 suggest fear. Values between these points represent a neutral sentiment.

Currently, the Bitcoin Fear & Greed Index stands at 55, reflecting a sentiment of greed among investors. This marks a shift from the recent trend of fear that dominated the market.

Historical Trends and Implications

The index had been in the fear zone just last week, with values dipping close to the extreme fear region – an area marked by values of 25 or lower. Historically, dips into extreme fear have often coincided with price bottoms for Bitcoin.

Conversely, spikes into the extreme greed zone, starting at 75, have historically been followed by market corrections. For example, Bitcoin’s all-time high earlier this year occurred when the index entered this territory.

Read more: Rumpel Labs Unveils Tokenization Platform for Airdrop Points

This pattern suggests that Bitcoin often moves in the opposite direction of prevailing market sentiment. Extreme sentiments, whether fear or greed, typically signal a potential market reversal.

Current Market Sentiment

With the recent shift from fear to greed, investor sentiment has turned bullish. However, as the hype is currently mild, Bitcoin is not expected to face immediate negative effects.

Investors should monitor the Fear & Greed Index in the coming days. Any significant spikes towards extreme greed could serve as a cautionary signal, indicating that the market may be overheating.

Read more: PayPal’s PYUSD Stablecoin Reaches $1B Market Cap

BTC Price Movement

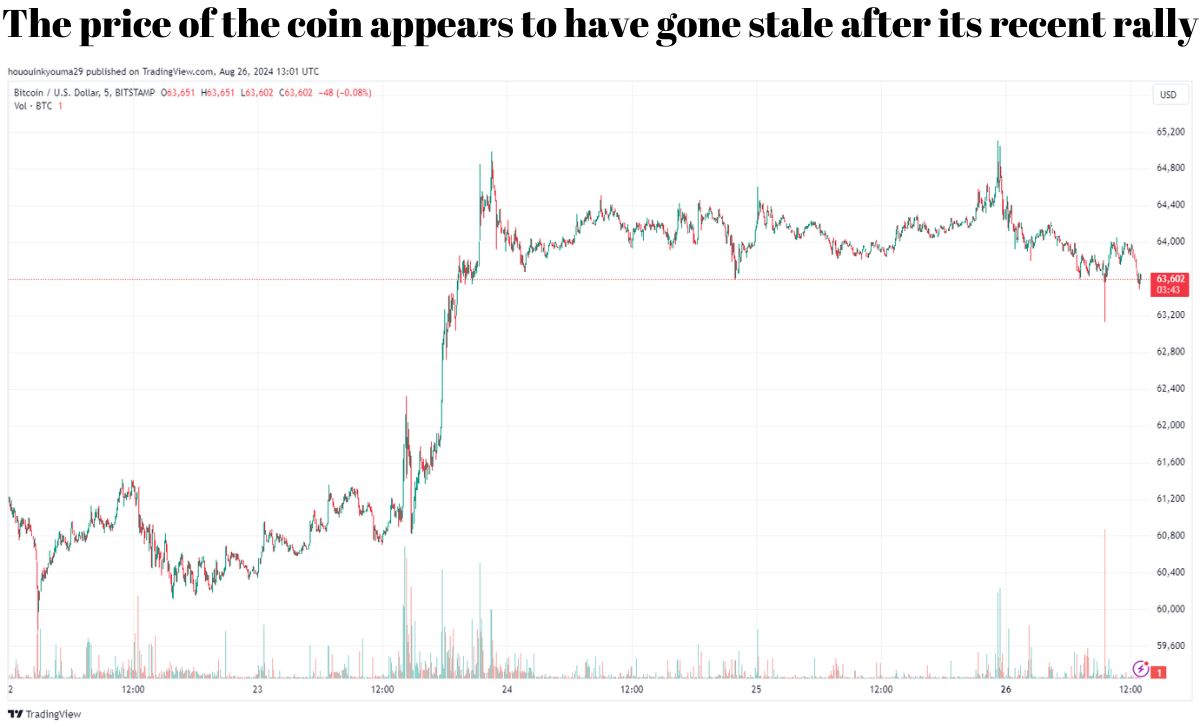

Bitcoin reached a high of $65,000 yesterday, but has since pulled back slightly to around $63,6

Cre: Bitcoinlist

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]