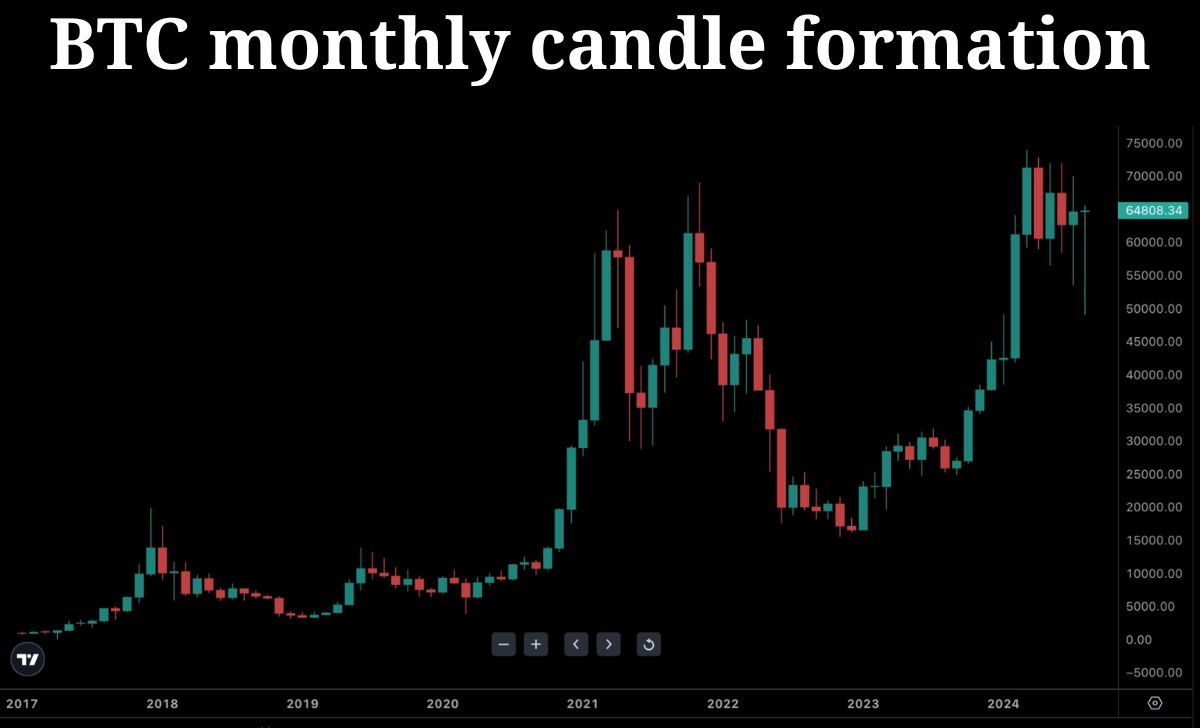

An analyst has suggested that the end of August could produce a highly “interesting monthly candle” on the Bitcoin chart, potentially signaling a trend reversal. However, others caution that with the month not yet over, fundamental factors may still significantly influence market movements.

On August 26, analyst HODL15Capital highlighted the possibility of arguably the most interesting monthly candle in Bitcoin’s history. The focus is on the formation of a potential dragonfly doji on the monthly chart – a candlestick pattern that could indicate a price reversal, either up or down, depending on previous price movements.

Speaking to Cointelegraph, FXPro senior analyst Alex Kuptsikevich noted that the dragonfly formation on Bitcoin’s monthly chart reflects optimism for a recovery after a challenging start to the month.

He added that this might signal a reversal of the negative trend that followed the all-time high in March. However, Kuptsikevich emphasized that it’s too early to confirm this pattern, as the month isn’t over.

Read more: Mpeppe Surpasses Husky Inu with 100x Gains, HINU Investor Joins Rivals

Kuptsikevich also mentioned that while Bitcoin has shown strength, particularly when it bounced back after a sharp decline earlier in the month, there are still significant technical hurdles to overcome. Bitcoin remains within a broad downward channel since March, and only a break above $68K would indicate a potential end to the downtrend.

Furthermore, surpassing the all-time high of around $74,000 could push Bitcoin into uncharted territory, potentially leading to rapid growth toward $110K. However, he also warned that Bitcoin might enter a prolonged consolidation phase before any significant upward movement.

On the other hand, Apollo Crypto analyst Henrik Andersson is less convinced by the technical signals, arguing that market fundamentals and sentiment are the primary drivers. He pointed out that recent market activity has been influenced by the German government’s Bitcoin sales and the Mt. Gox BTC distribution. Looking ahead, Andersson believes that U.S. Federal Reserve rate decisions and the upcoming U.S. elections will play a significant role in shaping market trends in the short to medium term.

Read more: Bitcoin Investors Turn Greedy Again – What’s Next for BTC?

As of August 27, Bitcoin prices had declined by 1.2% to $63,150. This shift has transformed the dragonfly doji into a hammer candlestick in the monthly time frame. While the hammer is also known for its bullish reversal patterns at the bottom of downtrends, the situation remains fluid as the month progresses.

Cre: cointelegraph

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]