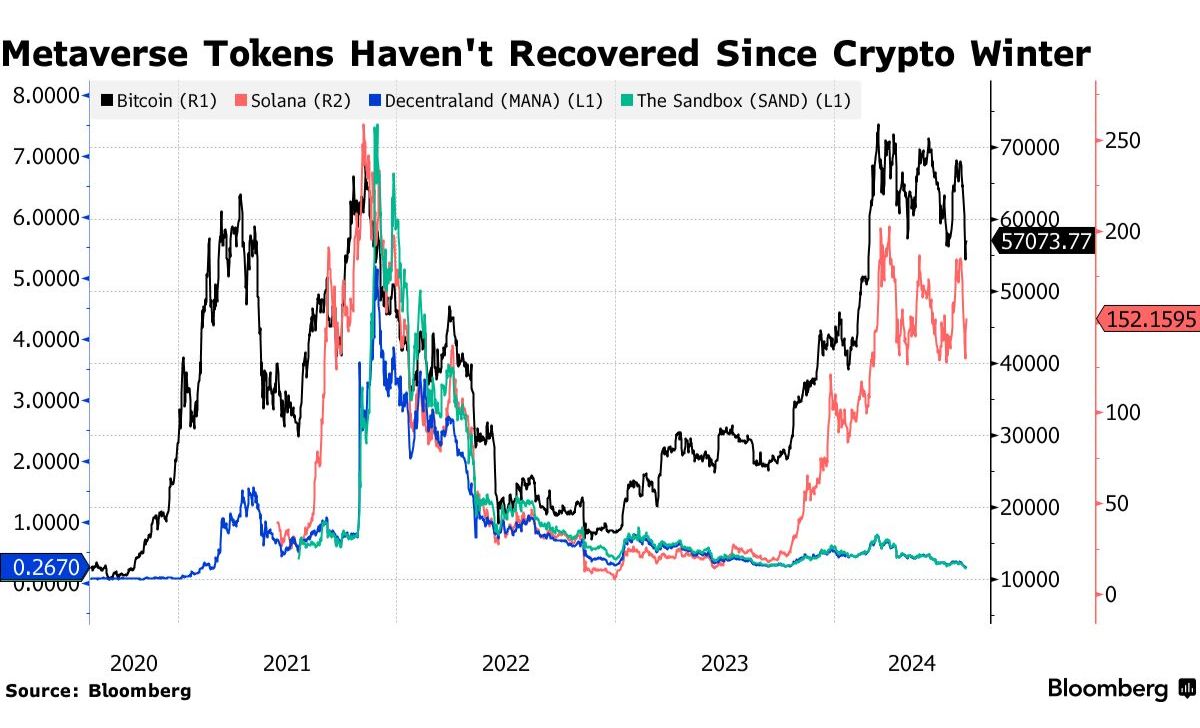

Despite recent market fluctuations, crypto winter seems to be fading for digital token traders. The introduction of spot Bitcoin exchange-traded funds in January and endorsements from Republican presidential candidate Donald Trump have helped the market recover from the turmoil caused by the FTX collapse.

However, the metaverse, which relies on digital assets, tells a different story. This interconnected network of digital worlds, envisioned as the new frontier for human creativity under the banner of web3, was built on blockchain technology and digital tokens. Web3 promised a space where people could monetize their creativity without interference from major tech companies. Yet, key indicators of web3’s value, such as the prices of NFTs and other tokens linked to popular platforms, are largely declining.

Andrew Kiguel, CEO of the metaverse company formerly known as Tokens.com, reflected on the situation: “We believed in the promise of web3, but upon closer inspection, it became clear that no one seems to be making money in this space. I challenge anyone to show me a web3 company that’s profitable.”

In 2021, Tokens.com made a significant investment in web3 by purchasing a $2.5 million plot of virtual real estate in Decentraland, a popular metaverse platform. Users could explore this virtual space through a web browser, engaging in activities such as poker games or fashion shows. Kiguel likened buying metaverse land to acquiring real estate in an emerging city, with plans to develop and lease part of their portfolio to tenants.

Parcels of digital property on such platforms are essentially tradeable, nonfungible tokens. Like other cryptoassets, they rise and fall in value in response to changes in demand.

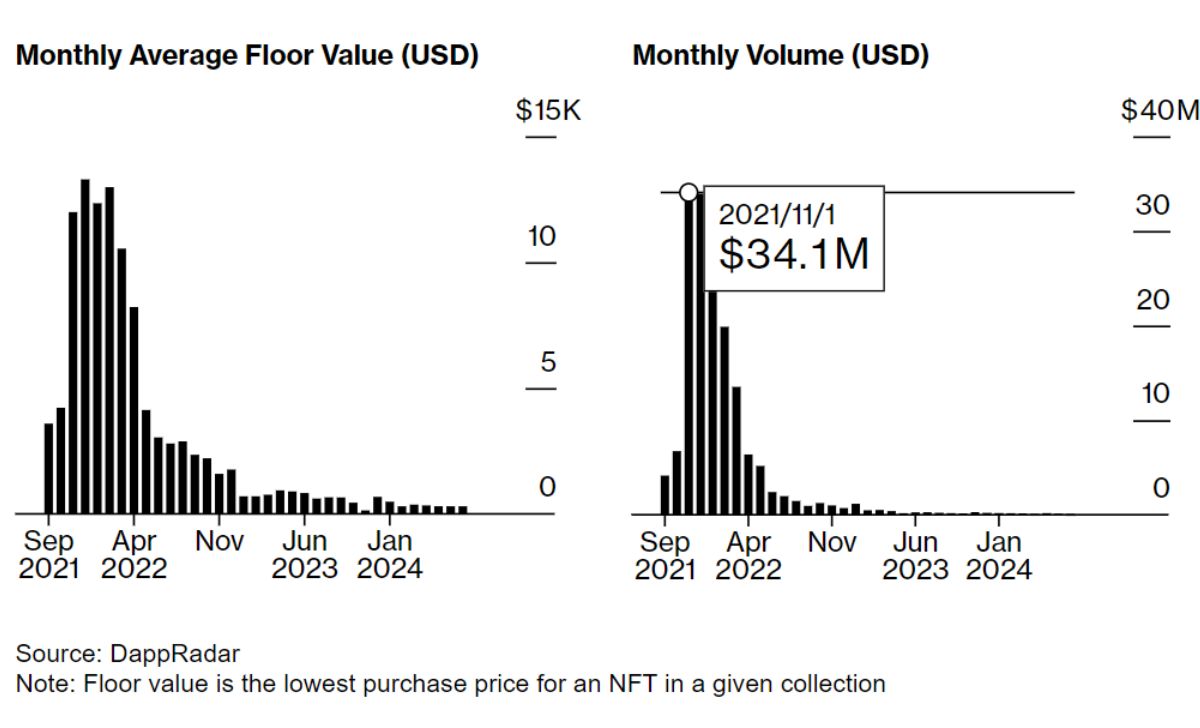

When a series of scandals rocked the crypto industry in 2022, Decentraland got clobbered along with the rest of the market. The community owned platform has lost about 90% of its user base, according to data site Decentraland Metrics, and its property values have dropped some 95%, according to data from blockchain information firm DappRadar. Mana, Decentraland’s cryptocurrency, now trades at around less than 30 cents versus a high of more than $5 in late 2021. Representatives for Decentraland did not respond to a request for comment.

Read: OpenAI Officially Challenges Google: The Search Engine War

Even big companies that sought to create their own, centralized versions of the metaverse have struggled. Meta Platforms Inc.’s Reality Labs recently reported a nearly $4.5 billion quarterly loss, underscoring the difficulties that even a tech baron like Mark Zuckerberg faces in squeezing a profit out of a digital existence.

Decentraland’s Virtual Real Estate Has Slumped to Record Lows

Values slid as Bitcoin bottomed out in November 2022

Tokens.com’s virtual real estate portfolio lost 80% of its value, according to Kiguel. The company has since ditched the metaverse, sought to formally change its name to Realbotix and started developing silicon humanoid robots powered by artificial intelligence following its purchase of Simulacra, which makes hyper-realistic sex dolls.

A business which aimed to offer Metaverse property loans also got hammered in the collapse. In early 2022, TerraZero Technologies Inc. had completed what it said was one of the first-ever metaverse mortgages, the start of a plan to improve access to digital property after surging prices squeezed out would-be buyers.

The company issued a loan for a property valued at $40,000, with a 25% down payment. It has rejected every loan application since, Dan Reitzik, the company’s chief executive officer, said in an interview. All the mortgage applicants were purely speculating on the price of land, and none planned to build anything, he said.

And when land values came crashing down, that first and only mortgage was returned at cost.

Crypto and NFTs are still too complicated for the average person, according to Reitzik. “The consumer is not ready for it. The brands are not ready for it,” he said.

A metaverse that runs on fiat currency is much more likely to attract the general public and businesses, Reitzik said.

James Casey, an associate professor of computer game design at George Mason University, shared a similar sentiment. He believes fiat currency and centralized assets are necessary for the metaverse to succeed in the near future.

Read: X Adds Payments Feature To Latest Dev Code Release Will Dogecoin Payments Follow?

Before entering academia, Casey spent over 12 years as a video game developer, creating massive multiplayer online games, a kind of predecessor to current expressions of the metaverse. These games often had customizable avatars, expansive worlds and in-game marketplaces where players could — with real money — buy, sell and trade virtual items.

“Blockchain is great technology but a game company wants to own their own databases,” he said. “When you have a virtual playground where you can do anything, people still want to own stuff, own the virtual world. They see it as just a new frontier of ownership.”

Cre: Bloomberg

David Ma was born in 1980 in California, is a Vietnamese American, known as one of the entrepreneurs and investors in the field of cryptocurrency and stock market. In 2006, he graduated from Stanford University with honors and began his career in business.

Email: [email protected]