In the second quarter of 2024, venture capital funding for crypto startups saw a notable increase in the total capital invested, driven primarily by significant investments in infrastructure projects.

According to Pitchbook’s August 9 report, crypto startups raised a combined $685 million in new capital during Q2, marking a 2.5% increase compared to the first quarter of the year. This growth occurred despite a 12.5% decrease in the number of deals.

Read more: Canto chain targets fixed amid 33-hour outage caused by consensus issue

Key Highlights from Q2 Funding

Infrastructure Projects Lead the Charge:

- Monad: A layer-1 platform that secured $225 million in a Series A funding round.

- BeraChain: A DeFi protocol with a new proof-of-liquidity model raised $100 million in a Series B round.

- Babylon: A Bitcoin restaking platform that raised $70 million in an early-stage round.

Mega-Rounds:

- Farcaster: A decentralized social media protocol that raised $150 million in a Series A round, reaching a $1 billion post-money valuation.

- Zentry: A blockchain gaming platform that raised $140 million in an early-stage round.

Market Trends and Outlook

Institutional Investor Confidence: The increase in total invested capital, despite fewer deals, suggests growing confidence among institutional investors in the crypto sector. Pitchbook anticipates that, barring major market downturns, investment volume and pace will likely continue to rise throughout the year.

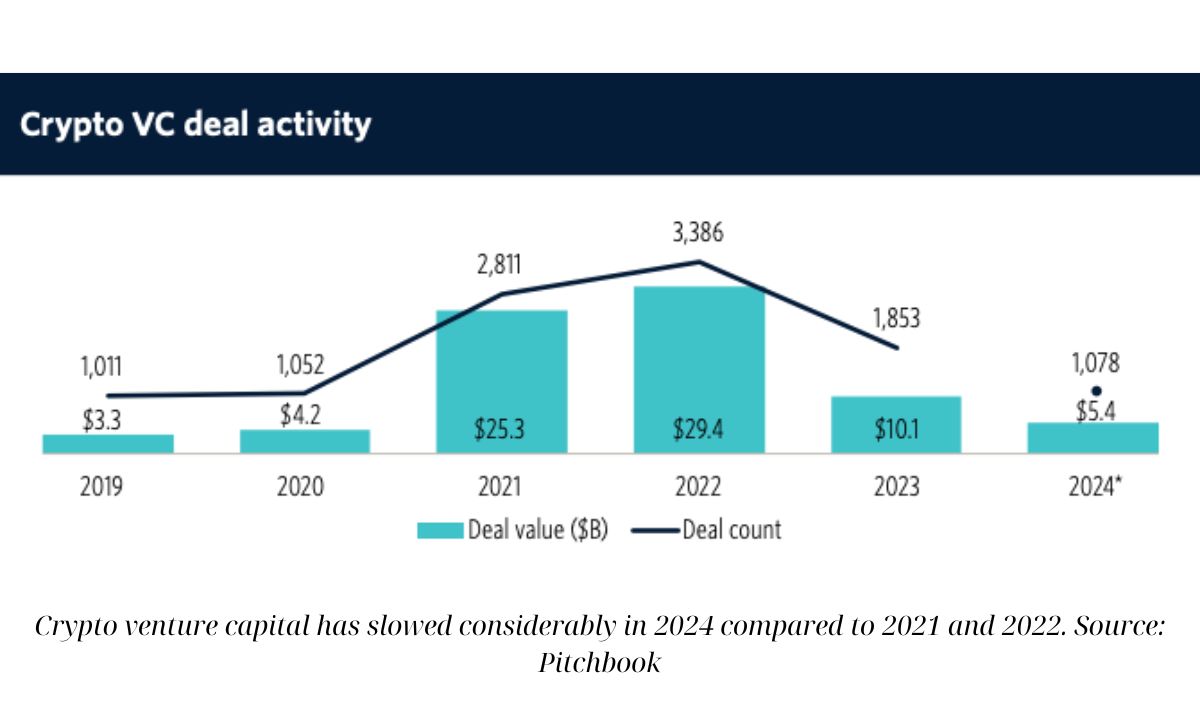

Funding Dynamics: While funding for crypto startups has slowed compared to the peaks of 2021 and 2022, where $25.3 billion and $29.4 billion were raised respectively, there remains significant interest in infrastructure projects and later-stage investments. The funding environment for early-stage startups has become increasingly competitive, whereas later-stage funding appears less competitive.

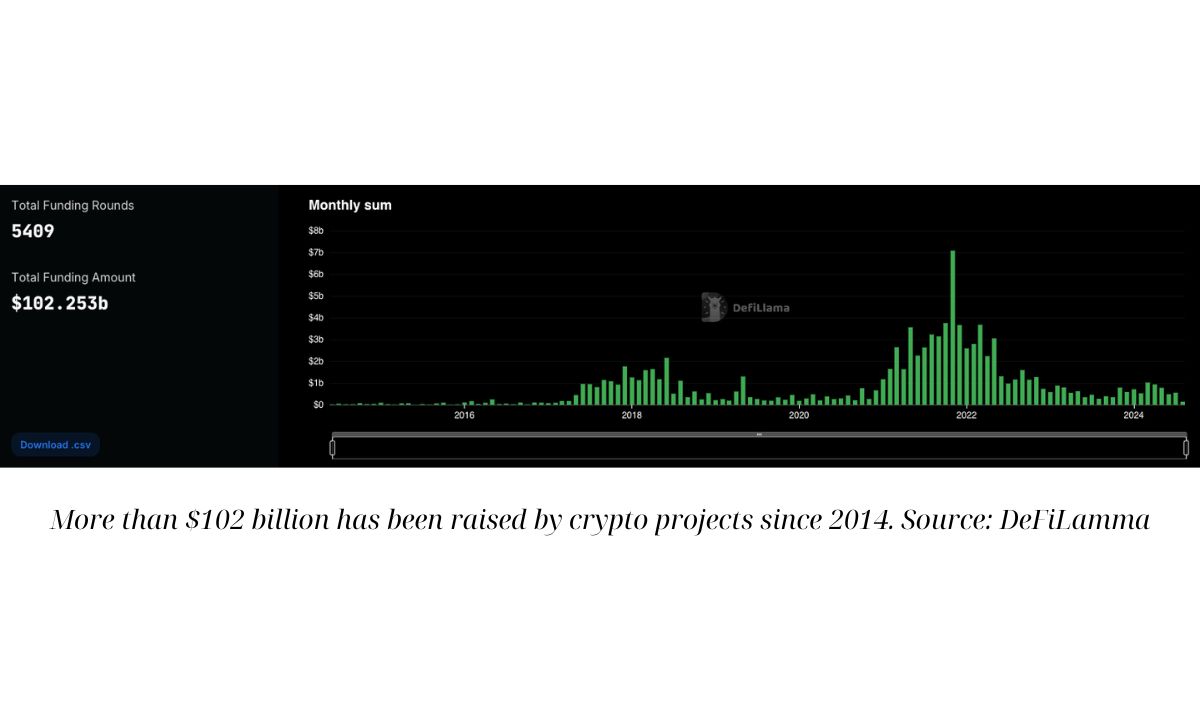

Historical Investment Figures: Since June 2014, over $102 billion has been invested in the blockchain industry across 5,400 funding rounds, according to DefiLlama.

Recent High-Profile Raises: Pantera Capital and Paradigm recently sought to raise $1 billion and $850 million, respectively, for new crypto funds. These efforts follow a record $4.5 billion raised by Andreessen Horowitz (a16z) in May 2022. Notably, a16z did not increase its cryptocurrency-focused fund despite raising $7.2 billion for various technology sectors in May.

This uptick in infrastructure funding underscores the growing institutional confidence and the strategic focus on foundational technologies that support the broader crypto ecosystem.

Cre: Cointelegraph

David Ma was born in 1980 in California, is a Vietnamese American, known as one of the entrepreneurs and investors in the field of cryptocurrency and stock market. In 2006, he graduated from Stanford University with honors and began his career in business.

Email: [email protected]