Ethereum (ETH) saw a notable dip to as low as $2,100 earlier this week but has since rebounded impressively, gaining 25% from its August 2024 lows. While there is optimism that ETH prices may continue to rise, breaching $2,800 and potentially reaching the psychological $3,000 mark, upcoming market events could pose challenges for bullish momentum.

Ethereum Network to Unlock Over 143,000 ETH

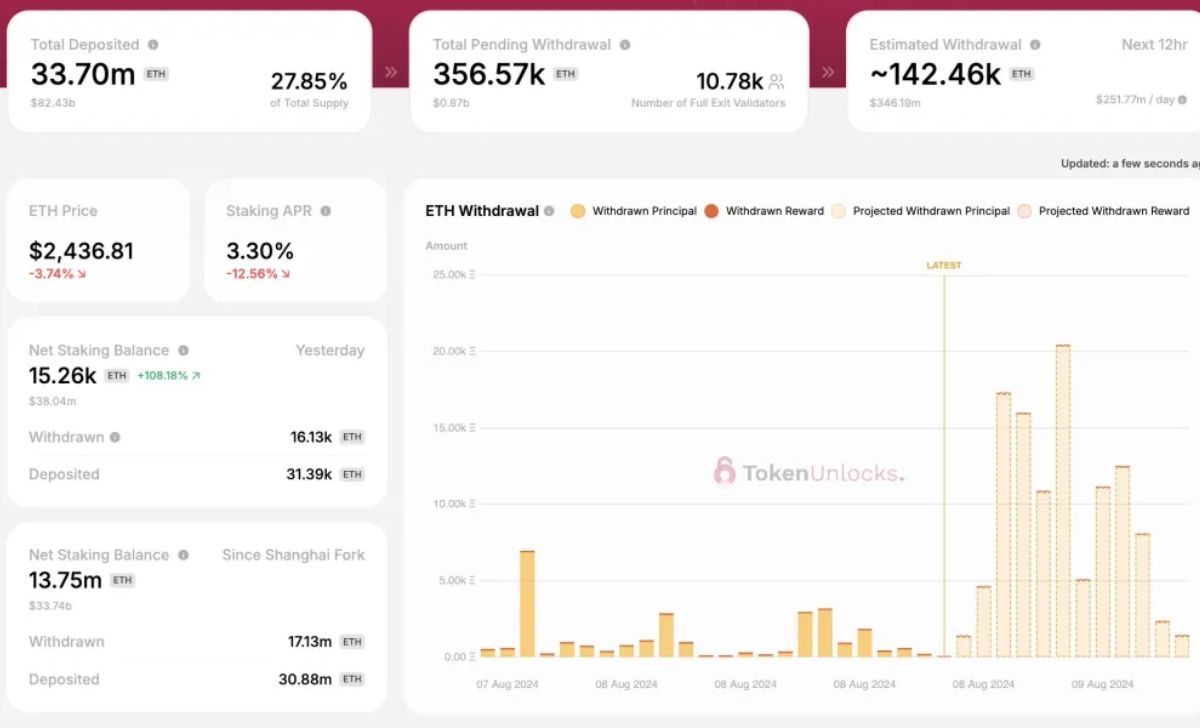

According to Token Unlocks data, a substantial amount of ETH is set to be withdrawn today. Validators are preparing to unlock 143,000 ETH, worth nearly $350 million. Additionally, another 212,000 ETH will become available in the coming days, which could put additional pressure on Ethereum’s price.

As of August 9, Ethereum’s circulating supply stands at over 120 million, based on CoinMarketCap data. Since the implementation of the Dencun upgrade, the network has become inflationary, with more coins being issued rather than burned.

Validators on the Ethereum network must stake at least 32 ETH and maintain high node uptime. They must also adhere to network consensus rules, avoiding activities like validating invalid transactions, which could result in penalties. Validators receive annual staking yields and rewards for block approvals.

The upcoming ETH unlock will include yields from staking activities, distinct from the block rewards distributed approximately every 13 seconds.

Read more: Spot Ethereum ETFs See First Green Day Since Launch With $34 Million Inflow

Impact on Prices and Market Sentiment

While the expected increase in ETH supply may raise concerns, Token Unlocks analysts suggest that the withdrawals do not necessarily guarantee immediate liquidation. However, if these ETH are sold, it could slow down Ethereum’s recovery.

Historically, large unlocks of Ethereum tokens have been associated with price drops. For instance, recent unlocks of between 150,000 and 220,000 ETH have coincided with declines in ETH prices.

Despite these concerns, Ethereum’s price is currently recovering. The immediate resistance level is around $2,600. Should buyers maintain momentum and confirm gains from August 8, ETH prices might rally and potentially test the $3,000 mark, despite the looming increase in available supply.

Cre: Bitcoinist

David Ma was born in 1980 in California, is a Vietnamese American, known as one of the entrepreneurs and investors in the field of cryptocurrency and stock market. In 2006, he graduated from Stanford University with honors and began his career in business.

Email: [email protected]