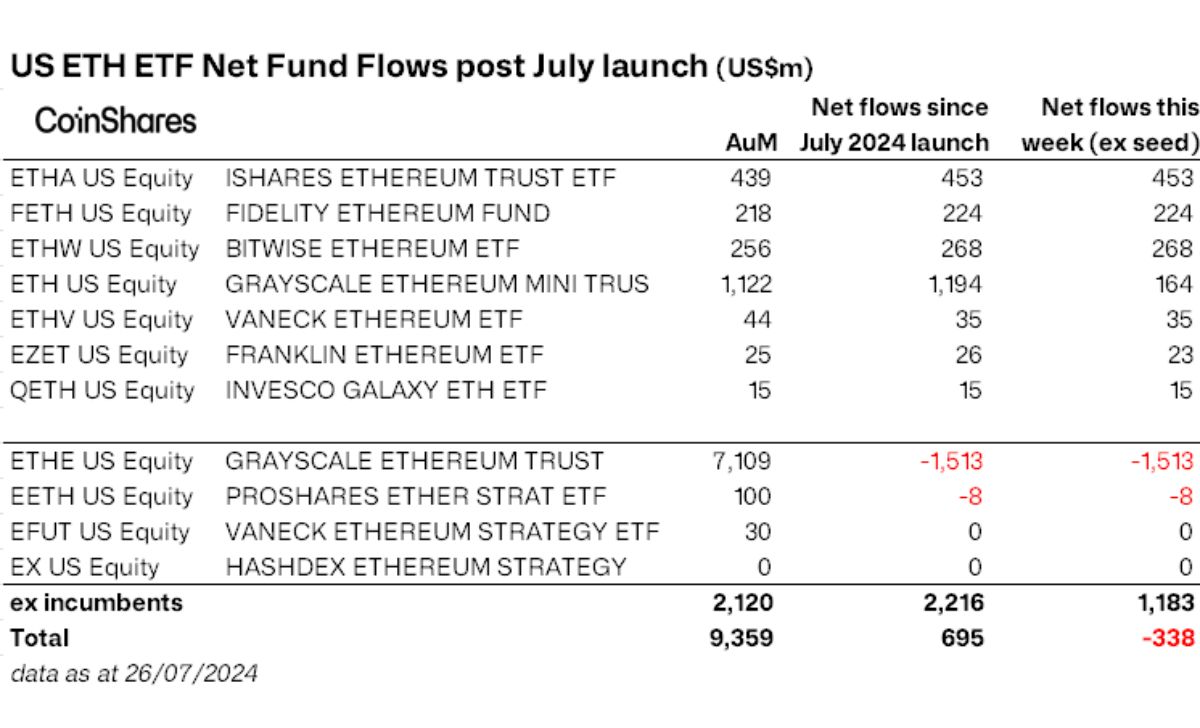

U.S. spot Ethereum (ETH) exchange-traded funds (ETFs) continue to experience outflows, though only one fund has reported net losses. On the fourth day of trading, the Grayscale Ethereum Trust (ETHE) saw more than $350 million exit the fund, increasing its total outflows to over $1.5 billion.

Ethereum ETFs Performance

Among the day’s top performers, BlackRock’s iShares ETF (ETHA) led with substantial net inflows of $87.22 million, raising its total inflows since inception to $439 million. The Grayscale Ethereum Mini Trust (ETH) also posted notable gains, attracting $44.94 million and bringing its total inflows since July 23, 2024, to $164.11 million.

Other gainers include Fidelity’s Ethereum Fund (FETH), which saw $39.26 million in new investments, Bitwise’s Ethereum ETF (ETHW) with $15.96 million, and Franklin Templeton’s Ethereum ETF (EZET) with a modest $6.21 million.

VanEck’s Ethereum ETF (ETHV), 21Shares Core Ethereum ETF (CETH), and Invesco Galaxy’s Ethereum ETF (QETH) experienced neutral flows despite strong trading volumes. The day’s net outflows were largely driven by Grayscale’s significant losses.

Related reading: Bitcoin ETF Transformation: ARK/21Shares Integrates Chainlink’s PoR For Major Update

Grayscale ETFs Flippening?

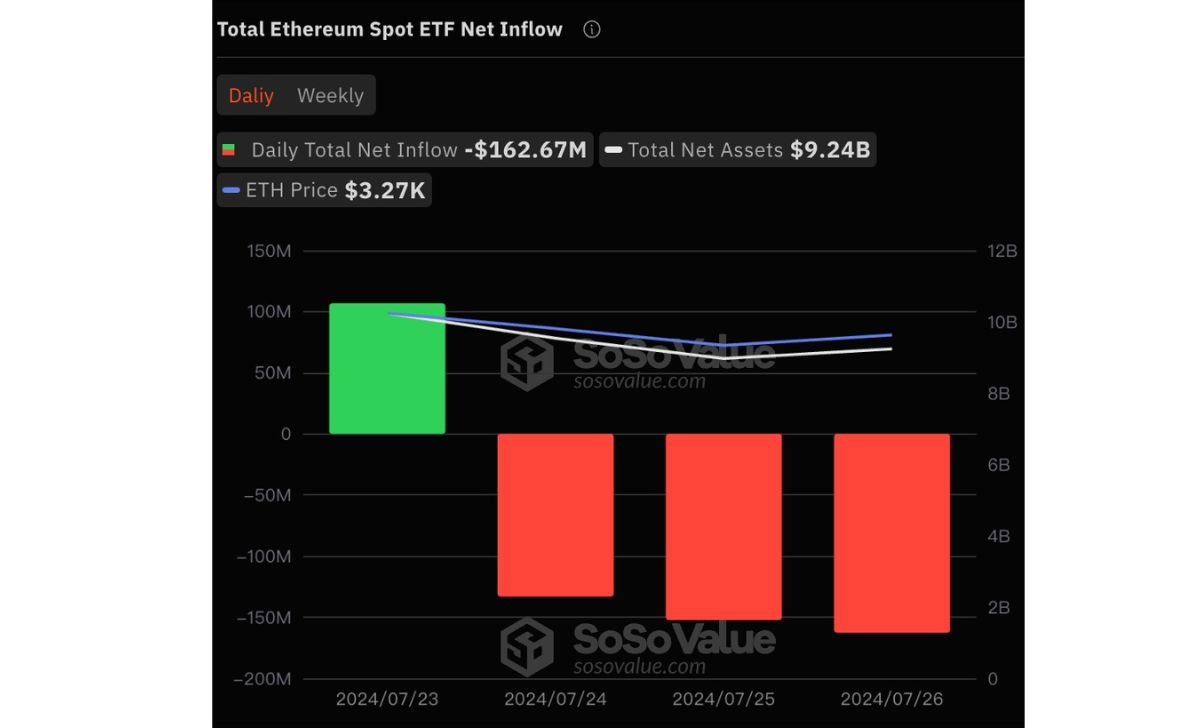

According to data from SoSoValue, U.S. spot Ethereum ETFs reported their third consecutive day of cumulative net outflows, shedding a total of $162.67 million on Friday, July 26, 2024. Grayscale’s Ethereum Trust (ETHE) experienced its fourth straight day of outflows, with $356.26 million leaving the fund, bringing its total outflows to over $1.5 billion.

Grayscale’s management fees appear to be the main factor behind these exits. ETHE charges a 2.5% fee, which is 1% higher than the Grayscale Bitcoin Trust (GBTC) and more than ten times the fee of most other funds. Most Ethereum ETFs currently offer a 0% fee, transitioning to between 0.19% and 0.25% after the waiver period. Interestingly, Grayscale recently launched the Ethereum Mini Trust, which has a 0% fee and will shift to a 0.15% fee post-waiver.

While the mini-fund seems to be mitigating some losses from ETHE, it has not been enough to fully counterbalance the significant outflows.

Potential Fund Depletion

Although this issue might not impact the broader crypto or Ethereum ETF markets significantly, Grayscale’s ETHE could face depletion within weeks if outflows continue at the current rate. With only $7.11 billion remaining in the fund, another ten days of outflows exceeding $300 million could halve the ETF’s net assets.

While it’s unusual for an ETF’s net assets to reach zero, if this were to occur, the issuer could close the fund. It remains unclear whether Grayscale plans to take this step, though their strategy to launch a larger ETH ETF with a 2.5% management fee, while maintaining a much smaller 0.15% fee for the mini-fund, may prove to be a costly gamble.

David Ma was born in 1980 in California, is a Vietnamese American, known as one of the entrepreneurs and investors in the field of cryptocurrency and stock market. In 2006, he graduated from Stanford University with honors and began his career in business.

Email: [email protected]