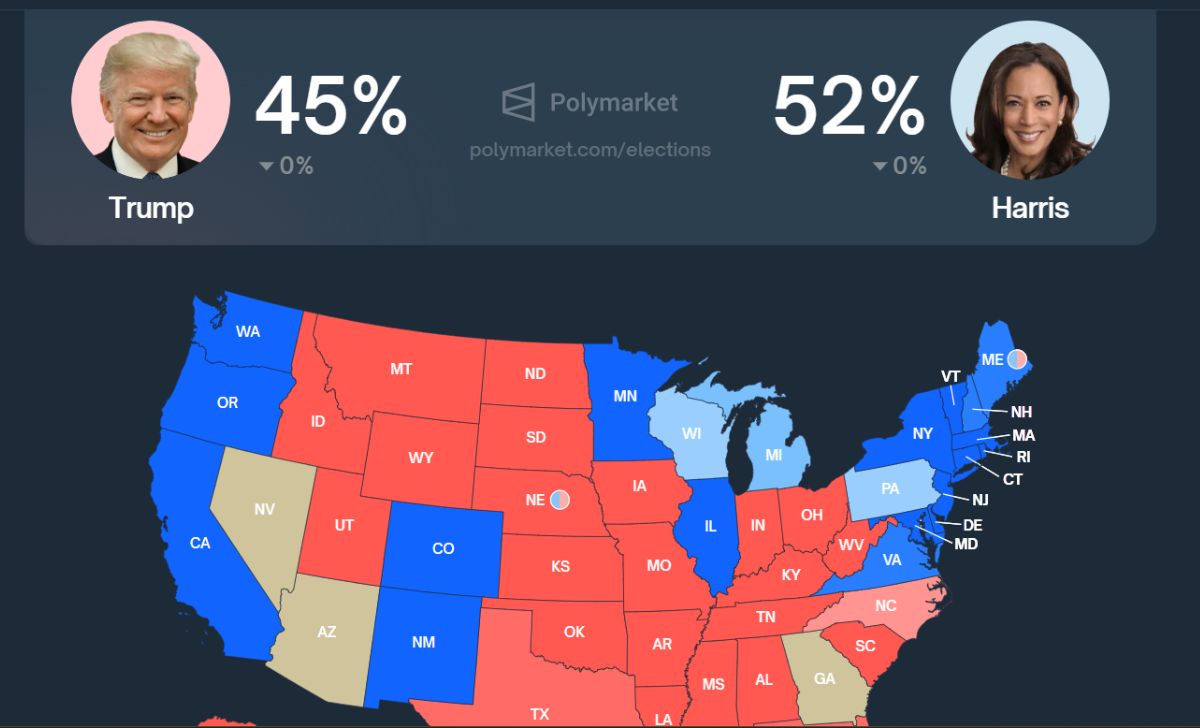

On Polymarket, a decentralized crypto prediction market platform, the odds for the upcoming US presidential election have shifted significantly. Current data shows Kamala Harris leading with 52% support, overtaking Donald Trump, who stands at 45%.

This marks a dramatic reversal from earlier trends where Trump was favored. Harris’s odds were only 33% at the time of her candidacy announcement.

Insights from Market Experts

Nick Tomaino’s Analysis:

- Prediction Market Mechanics: Nick Tomaino, founder of 1confirmation, explains that prediction markets aggregate diverse opinions from stakeholders financially invested in the outcomes. He emphasizes that these markets reflect a consensus view, as participants have “skin in the game.”

- Rebuttal to Manipulation Concerns: Tomaino addresses concerns about dark money influencing the prediction market. He argues that platforms like Polymarket are resilient to manipulation due to their robust market mechanisms. Large influxes of capital intended to skew perceptions would be quickly absorbed by market makers, ensuring that the market price reflects true consensus.

- Market Efficiency: Tomaino notes that while substantial funds might momentarily sway predictions, the market’s self-correcting nature ensures that the true market price is maintained. This contrasts with traditional media, which can be more susceptible to manipulation.

Read more: Crypto startup funding grows to $2.7B in Q2 despite falling in total deals

Anatoly Yakovenko’s Perspective

Economic Rationality: Anatoly Yakovenko, founder of Solana Labs, questions the rationale behind spending vast sums to influence the prediction market. He suggests that such spending might not be cost-effective if it contradicts reality and questions the value of appearing as the favorite within the margin of error.

Market Dynamics

Temporary vs. Long-Term Shifts: Tomaino acknowledges that while large funds can cause temporary distortions, sophisticated market makers and their incentives help to correct these shifts. He contrasts this with legacy and social media, which can be more easily manipulated.

Perceptions of Manipulation: Users on Polymarket highlight that subtle shifts in prediction markets can appear as genuine sentiment changes, whereas overwhelming manipulation would be more evident and less believable.

In summary, the recent changes in Polymarket’s prediction odds highlight the complexities of market dynamics and the robustness of decentralized platforms in maintaining accurate reflections of consensus. Despite concerns about manipulation, experts argue that the mechanisms within these markets help ensure transparency and resistance to undue influence.

Cre: Bitcoinist

David Ma was born in 1980 in California, is a Vietnamese American, known as one of the entrepreneurs and investors in the field of cryptocurrency and stock market. In 2006, he graduated from Stanford University with honors and began his career in business.

Email: [email protected]