Bitcoin and Ethereum Face Bearish Pressures, With Institutions Shifting Focus to Ethereum

Recent daily chart performances reveal that Bitcoin, Ethereum, and other leading altcoins are experiencing bearish trends. Despite being the most liquid cryptocurrencies, Bitcoin and Ethereum have seen double-digit declines over the past trading week. As bullish forces attempt to push prices higher, traders are carefully observing how the market will respond in key liquidation zones.

Institutions Favoring Ethereum Over Bitcoin?

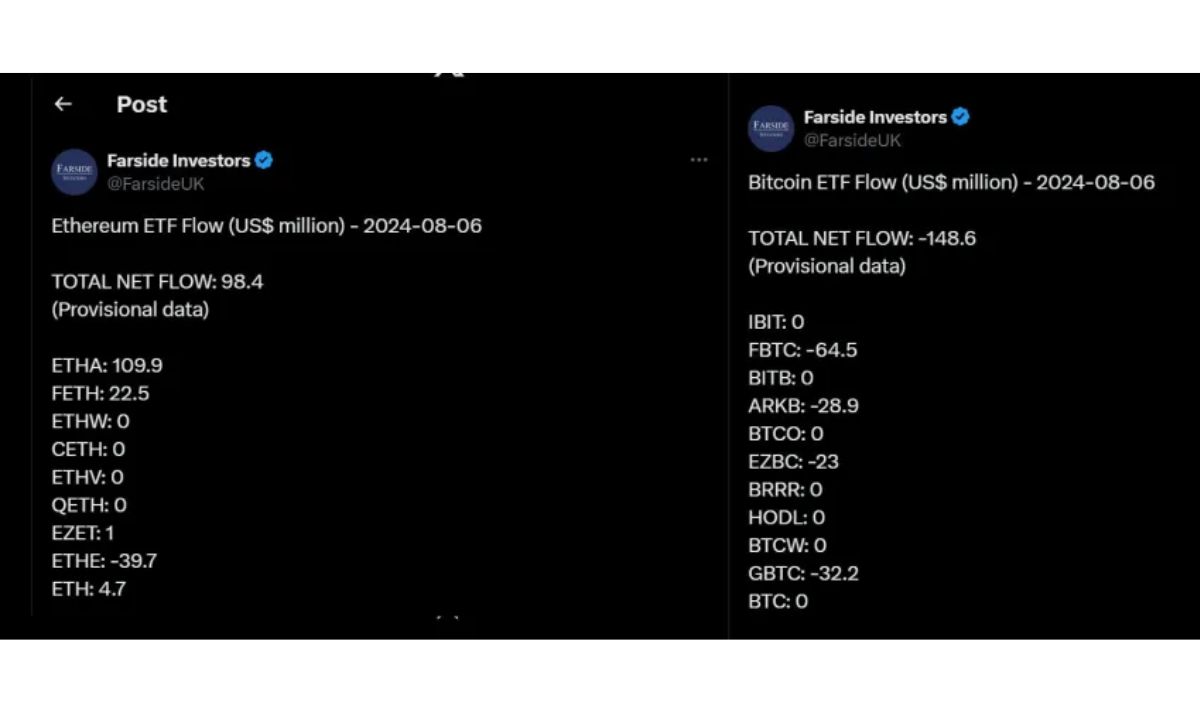

An emerging trend has caught the attention of analysts: while Bitcoin remains a primary focus due to its dominance and role as a base currency for many crypto pairs, there is notable movement towards Ethereum. Recent spot ETF flow data shows a significant shift as institutions are reallocating their investments from Bitcoin to Ethereum.

Related reading: Solana ETF Approved in Brazil: SOL Price Hit New ATH Against Ethereum

Recent data highlights a surge in capital flowing into Ethereum spot ETFs, contrasted with a decline in Bitcoin ETF investments. This shift has fueled optimism that Ethereum may absorb the current selling pressure and potentially break through local resistance levels of $2,800 and $3,300.

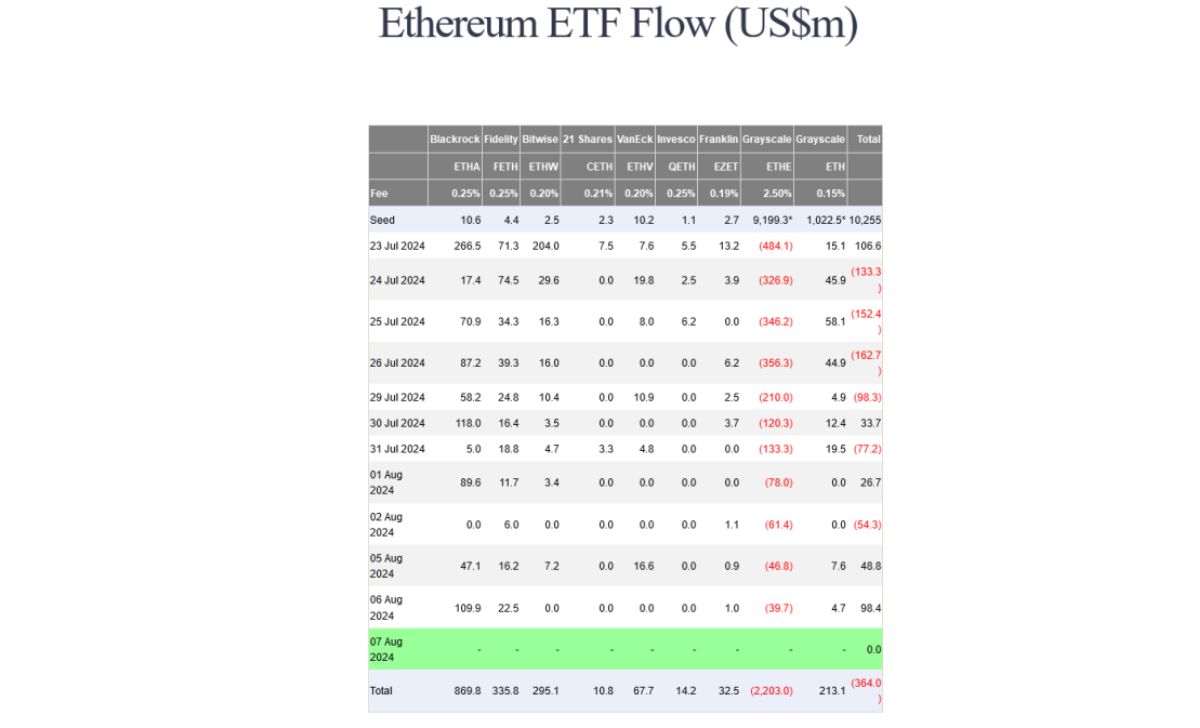

To illustrate this trend, BlackRock’s iShares Ethereum Trust (ETHA) has seen substantial capital inflows since its launch, accumulating nearly $870 million, according to Farside. Notably, during the price flash crash on August 5, investors purchased $50 million worth of ETH through ETHA, with an additional $109 million bought on August 6.

Farside’s trading data for August 6 shows that spot Ethereum ETFs experienced inflows exceeding $98 million, led by ETHA with $109 million. In contrast, Fidelity’s FETH recorded $22.5 million in net inflows, while Grayscale’s ETHE experienced outflows of $39.7 million.

Spot Bitcoin ETFs Experience Outflows, But BTC Remains Strong

On the other hand, spot Bitcoin ETFs faced outflows totaling $148 million on August 6. Institutions appear to be favoring BlackRock’s Ethereum ETFs over Bitcoin, as the IBIT spot Bitcoin ETF from the same asset manager did not see any inflows. Instead, Fidelity’s FBTC and Grayscale’s GBTC experienced outflows of $64 million and $32 million, respectively.

This shift in institutional preference suggests that Ethereum may recover losses against Bitcoin in the near future. Although Bitcoin remains in a bullish breakout pattern and is reaching multi-year highs relative to Ethereum, the increased demand for ETH could signal a potential change in the current trend.

Cre: Bitcoinist

David Ma was born in 1980 in California, is a Vietnamese American, known as one of the entrepreneurs and investors in the field of cryptocurrency and stock market. In 2006, he graduated from Stanford University with honors and began his career in business.

Email: [email protected]