Ponzi scheme is one of the popular forms of financial fraud, where participants are promised high profits but in fact the new participants’ money is used to pay interest to old investors. A typical example is the scheme of Charles Ponzi in the 1920s.

Discover more about how it works and famous examples in the AZcoin article.

What is a Ponzi scheme?

Ponzi scheme is a form of financial fraud in which the founder uses new investors’ money to pay profits to old investors. This creates the illusion of a highly profitable and stable investment, attracting more people to invest.

Origin of Ponzi scheme

The Ponzi scheme is named after Charles Ponzi, a notorious financial fraudster in the early 20th century. Charles Ponzi immigrated from Italy to the United States in 1903. He exploited investors’ confidence by promising high returns quickly through an unsustainable financial scheme. His model made him one of the most infamous fraudsters in history; thus, the term “Ponzi scheme” refers to similar financial fraud schemes.

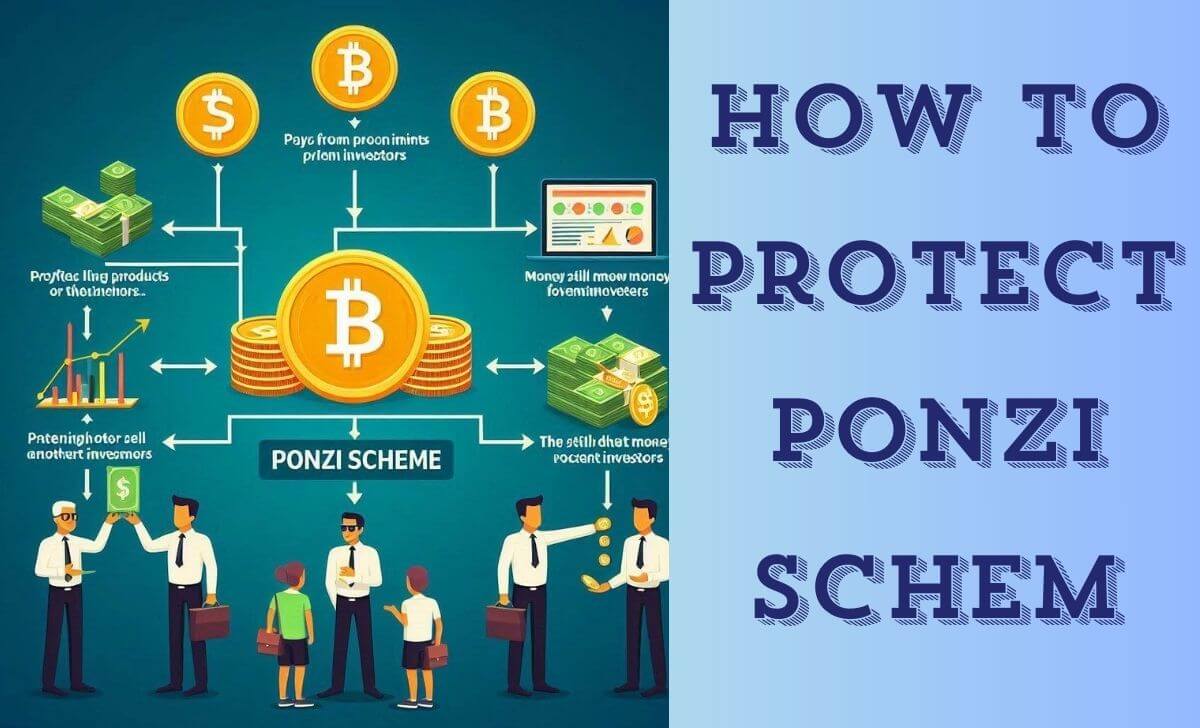

How Ponzi scheme works

The operation mechanism of a Ponzi scheme is straightforward yet highly risky:

- Attracting investors: The operator promises high and quick returns, often exceeding market average profits. They may use attractive marketing strategies, creating false trust and credibility to lure investors.

- Paying returns to previous investors: Instead of investing in profitable ventures, the operator uses new investors’ money to pay returns to earlier investors. This creates an illusion of profit and attracts more investors.

- Sustaining operations by attracting new investors: To sustain the Ponzi scheme, the operator must continuously attract new investors and use their money to pay returns to earlier investors. This cycle continues until there’s insufficient new money to pay returns, causing the Ponzi bubble to collapse.

Characteristics of recognizing a Ponzi scheme

A Ponzi scheme exhibits easily identifiable characteristics if observed closely and with caution:

- Unrealistically high profit promises: The operator promises high and quick returns, often exceeding market average profits. They may use attractive marketing strategies, creating false trust and credibility to lure investors, including crypto whales.

- No clear investment strategy: Legitimate investment firms have transparent and well-defined investment strategies. In contrast, Ponzi scheme lack any information about investments or strategic direction.

- Lack of information: Ponzi scheme typically lack transparency about their operations. Operators may use reasons like “trade secrets” to justify not disclosing operational details.

- Excessively high interest rates: Ponzi scheme promise abnormally high interest rates that far exceed market averages. Such rates are unsustainable in reality and serve as a clear indicator of a Ponzi scheme.

- Absence of independent financial reports: Legitimate investment companies have audited financial reports from independent entities. However, with Ponzi scheme, financial information is often concealed or lacks any independent audits.

Negative impact of Ponzi scheme

Ponzi scheme can have serious repercussions for investors and the financial markets in general. Some negative impacts of Ponzi scheme include:

- Financial losses: When the Ponzi scheme collapses, investors lose their entire invested amount with no recourse to recover it.

- Loss of market confidence: The emergence of Ponzi scheme can erode investor confidence in the financial markets and undermine its stability, impacting both mainstream assets and niche investments like Bitcoin ETF and low cap coin.

- Adverse effects on legitimate investment companies: Ponzi scheme can negatively impact legitimate investment companies by reducing investor trust and confidence in them.

Famous examples of Ponzi scheme in the crypto market

In recent years, the cryptocurrency market has witnessed several notorious Ponzi scheme. Below are some prominent examples:

Bitconnect Ponzi scheme

Bitconnect was introduced as a platform for lending and investing in cryptocurrencies, promising attractive profits of up to 40% per month. However, after attracting thousands of investors, the system collapsed, causing investors losses estimated at $2.5 billion.

OneCoin Ponzi scheme

OneCoin is another well-known case of a Ponzi scheme in the cryptocurrency market. The company managed to attract approximately $3.8 billion from over 3 million investors worldwide before being exposedto fraud and shut down by the German government in 2017.

Bernie Madoff Ponzi scheme

In history, Bernard Madoff’s Ponzi scheme is considered one of the largest and most impactful. Over 20 years, Bernard Madoff attracted billions of dollars from investors by promising exceptionally high returns. However, in 2008, the Ponzi bubble burst and Bernard Madoff was sentenced to 150 years in prison for financial fraud.

Allen Stanford Ponzi scheme

Allen Stanford attracted billions of dollars from investors by offering high-yield certificates of deposit. However, Stanford didn’t invest in any projects and used new investors’ money to pay returns to earlier investors. Stanford’s Ponzi scheme collapsed in 2009 and he was sentenced to 110 years in prison.

Elizabeth Holmes and Theranos Ponzi scheme

Elizabeth Holmes and her healthcare company Theranos attracted millions of dollars from investors by promising revolutionary blood-testing technology at a lower cost. However, after being exposed to fraud, the company had to shut down and Holmes was convicted of financial fraud.

How to protect yourself from Ponzi scheme?

To safeguard yourself from Ponzi scheme, there are several preventive measures and precautions you can take:

Thorough research on companies before investing

Before investing in any project, it is crucial to thoroughly research the company and its operators. This helps ensure they operate transparently, have a good reputation and are not involved in any fraudulent activities. Check their history, company information, operational certifications and reviews from other investors for an overall perspective.

Exercise caution with unrealistically high profit promises

One of the clear signs of a Ponzi scheme is promising excessively high profits that exceed market capabilities. When someone promises extremely high returns without risk, question it and carefully consider before investing. Always remember that no investment offers stable and above-average profits without corresponding risks.

Check for clear information

Legitimate investment companies have financial reports audited by independent entities. Before investing, request to see the company’s financial reports and verify if they are audited by a reputable organization. If there are no financial reports or if information is concealed, it could be a red flag of a Ponzi scheme.

Be cautious with novel investment forms

When encountering new or unfamiliar investment forms, maintain a cautious attitude and refrain from investing without understanding the project’s operational mechanism. Don’t get swayed by enticing advertisements without conducting a thorough research and evaluation process.

Conclusion

Above is an overview of the Ponzi scheme, a form of financial fraud that caused serious damage to investors. Hopefully, this article has helped you better understand the mechanism of action and famous examples. To learn more about the safest and most trustworthy best cryptocurrency exchanges in 2024, flow AZcoin.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]