Mutual Funds are a popular form of investment that allows small investors to access the financial market without having to have in-depth knowledge.

In this article, let’s AZCoin learn about Mutual Funds, the benefits of investing in these funds, their classification, how they work and how to participate in cryptocurrency investment funds.

What are Mutual Funds?

Mutual funds are a type of investment fund that pools money from many investors to invest in a diversified portfolio of securities, such as stocks, bonds or other assets.

These funds are managed by professional fund managers who decide how to allocate assets within the fund to achieve specific investment objectives.

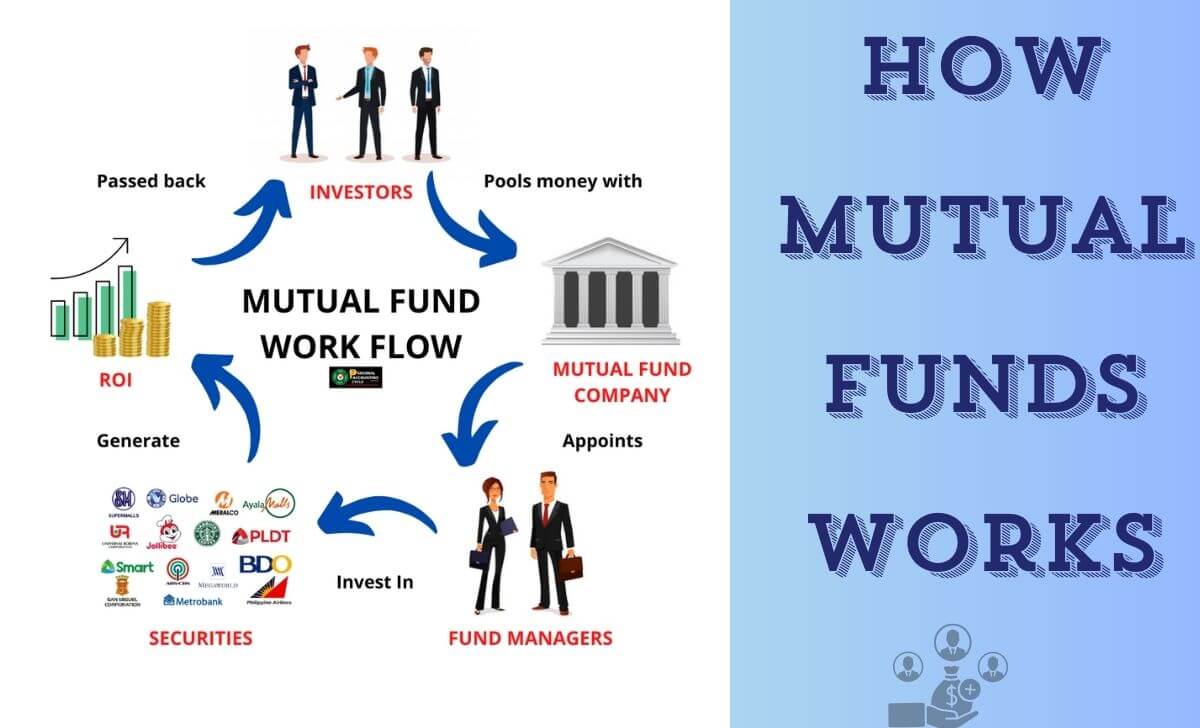

How Mutual Funds works

Mutual Funds operate on the principle of pooling capital from many investors to form a large fund. This fund is then managed by a professional fund management company, such as BlackRock. The company decides how to invest the money in the fund based on predetermined goals and strategies. When investors buy fund certificates, they essentially own a part of the fund.

The value of the fund certificate will change according to the value of the assets that the fund invests in. If the fund performs well and the value of the assets increases, the value of the fund certificate will also increase, bringing profits to investors. Conversely, if the fund performs poorly, the value of the fund certificate will decrease.

Mutual Funds classification

Below are the common types of Mutual Funds:

Equity Funds

Equity funds invest primarily in the stocks of publicly traded companies. The goal of this type of fund is to generate high returns from stock price appreciation and dividends. Equity funds can be further classified by sector, market capitalization (small, mid, large) or investment strategy (growth, value, income). Investing in equity funds can provide high returns but also comes with a high level of risk due to fluctuations in stock prices.

Bond Funds

Bond funds invest in bonds and other debt instruments. The main goal of this type of fund is to generate steady income from bond interest and protect the invested capital. Bond funds can invest in government bonds, corporate bonds, or bonds of other organizations.

Bond funds can also be classified by maturity (short-term, intermediate-term, long-term) and the credit rating of the bond. They introduce investors to fixed-income investments that offer stability and predictable returns.

Money Market Funds

Cash funds invest in short-term, highly safe financial instruments such as certificates of deposit, short-term government bonds and commercial paper. The goal of a cash fund is to preserve capital and provide high liquidity at a lower yield than other types of funds. Cash funds are generally considered a safe option for investors who want to hold cash while still earning a little interest.

Mortgage Funds

Mortgage funds invest in mortgage loans, including mortgage bonds and mortgage-backed securities. The goal of this type of fund is to generate income from the interest on the mortgage loans it holds. Mortgage funds can invest in residential mortgages, commercial real estate or both.

Diversified Funds

Diversified funds invest in a broad portfolio of assets, including stocks, bonds, and cash. The main goal of a diversified fund is to reduce risk by spreading investments across different asset classes. This type of fund is often suitable for investors seeking a balance between risk and return.

Benefits of investing in Mutual Funds

Investing in Mutual Funds offers many benefits to investors. Here are some of the key benefits:

Portfolio diversification

One of the biggest benefits of investing in Mutual Funds is the ability to diversify your portfolio. When you invest in a mutual fund, your money is spread across a variety of assets, including equity investments and crypto asset management, which helps to reduce risk. This is important in a volatile market.

Professional management

Mutual funds are managed by experienced financial professionals. They conduct research and analysis to make the best investment decisions for the fund. This gives investors peace of mind when entrusting their money to knowledgeable and skilled people.

High liquidity

Mutual Funds are typically highly liquid, which means that investors can easily buy and sell fund units. This gives investors more flexibility in managing their assets, especially in situations where they need cash urgently.

Low costs

Compared to investing directly in stocks or bonds, the cost of investing in Mutual Funds is usually lower. You don’t have to pay transaction fees for each transaction, but only pay an annual management fee to the fund management company.

How to invest in Mutual Funds

To invest in Mutual Funds, you need to follow some basic steps. Here is a detailed guide:

- Learn about investment funds: Before deciding to invest, you need to learn about the mutual funds available in the market. There are many types of funds with different investment strategies, so consider your investment goals to choose the right fund.

- Open an investment account: After choosing an investment fund, you need to open an investment account with a fund management company or through a stockbroker. This process is usually simple and can be done online.

- Deposit money into the account: After opening an account, you need to deposit money into the account to start investing. The minimum amount to invest in mutual funds may vary depending on the fund.

- Place an order to buy fund certificates: Finally, you can place an order to buy fund certificates through your investment account. Once the order is executed, you will receive the fund certificate and start tracking the growth of your investment.

Conclusion

Above is the information about the types of Mutual Funds and how to participate in Crypto Mutual Funds. Hopefully you have a clearer view of these investment funds and how to get started. Don’t forget to follow AZ – best crypto exchanges to optimize your investment strategy.

I’m Jessi Lee, currently living in Singapore. I am currently working as a trader for AZCoin company, with 5 years of experience in the cryptocurrency market, I hope to bring you useful information and knowledge about virtual currency investment.

Email: [email protected]